Low Income Apartments Accepting Section 8 Near Me

Finding an affordable rental apartment can be challenging, especially for low-income households relying on a Section 8 housing choice voucher. Luckily, many quality landlords accept Section 8 tenants and provide comfortable homes nationwide. Let’s explore expert tips for locating apartments welcoming voucher holders like yourself nearby.

Understanding Section 8 Rental Assistance Basics

First, a quick primer on how the Section 8 program functions to contextualize the rental search process:

Federal Rental Subsidies For Qualified Applicants

Section 8 provides rent support vouchers allowing very low-income families, seniors, and disabled individuals to lease private market apartments charging below Fair Market Rent rates determined for their area.

Tenant Rent Portions Capped At 30% Of Income

Your out-of-pocket rental contribution is typically ~30% of your monthly income. The housing authority pays the additional amount directly to landlords.

Meet Income Limits And Other Requirements

Households must fall under income thresholds and meet voucher eligibility rules regarding citizenship status, criminal histories, eviction records, etc.

Locating Landlords Accepting Section 8 Vouchers In Your Area

Low Income Apartments Accepting Section 8 Near Me

So how do you pinpoint available rentals and receptive landlords welcoming voucher holders like yourself?

Check Government Affordable Housing Databases

AffordableHousing.com and GoSection8.com let you filter statewide or metro-level rental listings by “Section 8 accepted” unit amenities, rent amounts, property types and more.

Search Section 8 Specific Online Listings Sites

Websites like GoSection8, SocialServe.Com and AffordableHousingOnlinecater specifically to voucher holders, with thousands of properties pre-screened for Section 8 eligibility.

Consult Your Housing Authority

The public housing authority (PHA) issuing your voucher maintains lists of registered Section 8 landlords across neighborhoods awaiting voucher tenants.

Drive Or Walk Around Desirable Neighborhoods

Check for “Section 8 Welcome” signs on apartment buildings while exploring ideal target communities. Jot down leasing office numbers or snap rental photos so you remember appealing options worth pursuing later on.

Evaluating Section 8 Friendly Apartment Listings

Low Income Apartments Accepting Section 8 Near Me

As listings emerge in your rent range near desired amenities, assess each carefully:

Confirm Voucher Payment Standards Alignment

Double check that a unit’s asked rent falls within your voucher’s payment standards, factoring in utilities costs and any allowable adjustments.

Cross-Reference Area Crime Statistics

Research area crime rates on websites like NeighborhoodScout to determine personal safety, especially if you have children who will play outside.

Call To Confirm Application Requirements

Touch base with leasing agents directly to clarify exactly what documents, fees, tenant background checks to expect through their rental application process.

Schedule In-Unit Viewings

Nothing replaces seeing amenities, space proportions, condition and quality firsthand! Photos can hide issues. Visit multiple units before applying.

Drive The Surrounding Community

Get a feel for the walkability, public transit access, nearby grocery options, proximity to schools/parks to ensure the neighborhood suits your family’s lifestyle.

Appealing To Landlords As A Section 8 Voucher Holder

Fair housing laws mean landlords can’t automatically deny your application due to the voucher. However, impressing property owners gives a competitive advantage, especially in tight rental markets.

Highlight Steady Section 8 Income

Emphasize how the stable housing assistance voucher payments essentially guarantee on-time monthly rents, worth prioritizing over other applicants.

Prepare All Required Documents

Pull together ID, income, credit, reference and background check files so your application proceeds smoothly without hassling the landlord chasing paper trails.

Offer Multi-Month Security Deposits

Proposing an extra security deposit equal to 2 or 3 month’s rent signals good faith security against property damages.

Volunteer For Credit + Background Checks

Being upfront inviting credit checks and tenant screenings demonstrates you have nothing to hide.

Refer Strong Past Landlord References

Glowing references vouching for your conscientious rental history gives landlords added confidence.

Questions To Ask Landlords Before Signing A Lease

Clarifying expectations in advance positions everyone for positive ongoing tenant-landlord communications. Key topics to cover include:

Are Any Unit Renovations/Repairs Planned?

Understand any planned appliance, flooring or fixture upgrades so you know what to expect unit condition-wise long term.

What Are Reasons For Eviction According To Your Policies?

Get clarity on late rent timelines, noise violations, guest policies and other priority house rules through the landlord’s perspective upfront.

Who Handles Emergency Maintenance Requests After Hours?

Ask how overnight or weekend repairs dispatch to a trusted on-call handyman or service company.

What Payment Methods Do You Accept For Rent + Fees?

Inquire about using secure options like direct debit, wires or checks to pay any out-of-pocket rental portions that are your responsibility.

How Do You Prefer We Communicate Regarding Lease Issues?

Cover the preferred methods and response times for managing lease questions or concerns arising once you move in.

FAQs: Section 8 Rentals Near Me

What documents will I need to provide for apartment applications under Section 8?

Typical documents include 2 recent pay stubs, tax returns, 6 months of bank statements, a copy of your voucher, social security cards for your family, a government-issues ID, birth certificates for dependents, plus collection letters or past rental ledgers if applicable.

How long does it usually take to get approved by landlords for a unit?

Timeframes vary greatly by property management company and market demand—anywhere from three days to a couple of weeks if credit/background checks are backlogged. Follow up if your application sits longer than 10 days.

Can I choose any rental listing or do units require Section 8 approval first?

You can only rent vouchers in units already registered through local housing authorities as participating in Section 8 programs—otherwise applications automatically get denied.

What costs am I responsible for besides my income-based rental portion?

You’ll owe the security deposit, a utility hook-up fee if required, utilities costs above the voucher’s approved allowance and any charges for damages beyond normal wear and tear.

Can landlords double my rent once the 12-month lease ends?

Rent increases on lease renewals face restrictions under Section 8. Generally only small incremental bumps (~5%) aligning with area median rents get approved by the housing authority.

Conclusion

In closing, locating an apartment suited for your family amongst Section 8 listings just requires targeted search strategies across the right databases, tailored communications reassuring quality landlords, plus thorough discussions clarifying move-in expectations. Lean on housing authority resources each step and you’ll be moving into affordable subsidized housing solutions enhancing not only your peace of mind but also quality of life. Best of luck securing rental assistance vouchers and securing wonderful apartments supporting household stability for years to come!

]]>

Foreclosed Homes For Sale Near Me Under $100k

Foreclosed homes can be excellent deals for homebuyers on a budget. With some fixer-uppers going for under $100k, you may be able to score your dream home for a fraction of what it would normally cost. Let’s explore tips for finding and buying a foreclosed home under $100k near you.

Identifying Foreclosures In Your Area

Foreclosed Homes For Sale Near Me Under $100k

The first step is identifying potential foreclosure listings in your desired area. According to RealtyTrac, over 560,000 U.S. properties entered some stage of foreclosure in 2022. Here’s how to pinpoint ones near you:

Check Foreclosure Listing Sites

Websites like RealtyTrac and Homes.com let you browse for pre-foreclosure, auction, and bank-owned listings nationwide. Filter by $100k or under and your target ZIP code to see options in your area.

Drive Neighborhoods Looking For Signs

Some foreclosures won’t be marketed online. Check areas you’d like to buy in for yard signs indicating a foreclosure sale. Jot down any relevant listing info so you can research them later.

Contact Local Real Estate Agents

Many agents specialize in foreclosure listings. A 2022 NAR survey found 36% of agents’ transactions involved foreclosures. Ask agents about any upcoming foreclosure auctions or bank-owned discounts under $100k.

Assessing Viability Of Sub-$100k Foreclosures

Once you’ve identified potential $100k or less foreclosure opportunities nearby, you need to decide if they’re worth pursuing.

Research Past Listing Details

Check a property’s listing history on sites like Zillow to find the prior sale amount and year – this gives insight into its condition and real market value.

Drive By The Home

Do a quick drive-by viewing of curb appeal, structure condition, neighborhood quality and any visible issues. For interiors, some listings let agents or buyers do walkthroughs prior to auction.

Check Comparable Sales

Look up what similar nearby homes have sold for to gauge if the foreclosure is seriously undervalued. Account for its repair needs in comparison.

Consult With An Inspector

For properties you’re serious about, you could arrange an $100-$400 inspection to assess required fixes like roofing, electric and plumbing prior to bidding. Then adjust your offer cost accordingly.

Bidding Strategically At Foreclosure Auctions

Foreclosed Homes For Sale Near Me Under $100k

Foreclosure auctions require strategic bidding to avoid overpaying while still beating out competitors all trying to score a deal.

Research Auction Details Thoroughly

Learn all auction terms, procedures, and property specifics so you can develop an informed bidding approach without surprise hurdles.

Set A Maximum Bid Threshold Based On Repair Costs

Have a clear top dollar limit aligned with your total budget – purchase amount plus estimated repair expenses. Stick firmly to this threshold during bidding wars.

Explore Financing Options Beforehand

Get preapproved for a mortgage, home equity loan or line of credit you can leverage for auction down payments, so you’re ready to bid quickly.

Attend In Person If Possible

Onsite bidding can help you react faster to competing offers and determine others’ limits compared to online or proxy bidding.

Have Contingency Plans If You Lose

If someone else wins that dream house, be ready to move forward. Have back-up auction prospects lined up or pivot to more traditional listings.

Navigating Buying Bank-Owned Foreclosures

Foreclosed Homes For Sale Near Me Under $100k

Purchasing bank-owned foreclosures (REO properties) has some unique advantages for discount home shoppers.

More Flexible Financing Options

Banks often offer special first-time homebuyer programs, low down payments or reduced Interest rates to sell REOs faster. Discuss these deals with loan officers.

Negotiate Repair Credits Or Discounts

Many REOs have accumulated deferred maintenance or outdated finishes. Use professional inspection results detailing fix-up costs to request repair credits or an overall lower purchase price from the selling bank.

Take Advantage Of As-Is Pricing

Buying properties on an “as-is” basis waives rights to request repairs from the seller. But this allows you to purchase well below actual resale value, budgeting renovation expenses yourself later on.

Don’t Let Cosmetics Overshadow Opportunity

Look past the ugly paint colors, worn carpets and overgrown lawns common in REOs to recognize an underlying structurally-sound property with cozy spaces and great locality at a very affordable investment.

Important Repairs To Budget For In Foreclosure Fixer-Uppers

While some gorgeous foreclosure diamonds just need a little polishing, most under $100k properties require more intensive repairs or overhauls before move-in ready. Common major updates include:

Roof Replacements Or Patch Jobs

Faulty roofs are a common issue. Inspect carefully then plan for full replacements or seals and spot fixes on leaks.

Plumbing & Electrical Rewiring

Outdated plumbing piping and insufficient electrical panels/wiring for modern usage often crop up in older houses. Address these safety issues early on.

HVAC Installations Or Tune-Ups

It’s common to find properties with broken A/C systems or inefficient heating needing upgrades like new energy-efficient equipment.

Kitchen & Bathroom Remodels

Even partially gutting and restoring kitchens/bathrooms with fresh cabinetry, sinks, lighting and flooring goes far in boosting livability and future resale appeal.

Structural Foundation & Wall Repairs

Look for obvious cracks in walls or ceilings, sticking doors/windows and foundation damage then consult structural engineers on necessary fixes.

Staging Foreclosure Listings To Attract Buyers

Cosmetic improvements also deserve budget dollars when rehabbing low-priced foreclosures, enhancing appeal for resale or rental investors. Consider:

Painting Walls/Ceilings With Neutral Colors

Fresh interior paint jobs do wonders breathing beauty into dusty dilapidated rooms, making them glow. Stick with light versatile beige, gray or white shades.

Refinishing Hardwood Flooring

See if worn parquet or oak flooring boards underneath nasty carpeting are salvageable through refinishing. Beautiful wood grain adds natural character.

Updating Light Fixtures And Hardware

Swap out outdated dangling overhead lights or mismatched metal hardware for affordable modern brushed nickel or bronze finishes.

Landscaping Shrubbery And Plantings

Curb appeal matters, so put in some manicured bushes, flower beds, stone paths to hide ugly fencing and brighten the entryway.

Financing Options For Foreclosure Purchases Under $100k

Creative financing opens doors for buying foreclosure bargains under $100k if you don’t have six figures of cash laying around or don’t qualify for traditional loans. Alternatives include:

FHA 203(k) Rehab Mortgages

FHA 203(k) loans offer low down payments and rolled renovation costs at fixed rates, but have borrowing limits and oversight rules.

HomeStyle Renovation Loans

HomeStyle mortgages also bundle purchase prices/repairs with flexible limits and lender oversight options.

Hard Money Or Private Lender Loans

Hard money loans via private individual investors offer quicker approvals and funding without all the red tape, but have higher rates/fees and short 1-year terms before needing refinancing.

0% Credit Card Balance Transfers

If you have excellent credit, consider applying for a 0% promotional APR credit card to finance smaller improvement projects or down payments interest-free for 12-18 months.

Personal Loans Or HELOCs

Personal installment loans or Home Equity Lines Of Credit tap into your other real estate equities or comparative creditworthiness

Purchasing discount foreclosures under $100K comes with unique hurdles. Being prepared helps you navigate them smoothly:

Allowing Extra Time For Contract Approvals

Banks and lenders review offers on bank-owned properties carefully before accepting, often needing more time vs typical 30-day closings.

Competing With All-Cash Bulk Investors

Large real estate investment groups often buy up foreclosures sight-unseen with full-cash bids, pricing out smaller budget buyers. Consider partnering with private lenders to make more competitive offers.

Inheriting Past Due Taxes Or Liens

Make sure to review any outstanding homeowners association dues, city tax bills, mechanic’s liens or penalties now attached to the property’s title which you may now be responsible for.

No Seller Disclosures Or Property History

Unlike traditional listings, buying foreclosures “as-is” waives rights to seller background info on prior issues, legal problems, or land surveys – so investigate thoroughly before committing.

Dealing With Former Occupant Drama

Angry or conniving past owners losing homes through foreclosure could pose headaches like delayed move-outs, property damage, unfinished contractor projects they started but didn’t complete.

No Access For Showings Or Inspections

With out-of-state banks as sellers and vacant properties, getting inside for appraiser valuations, buyer walkthroughs, contractor estimates may be difficult if changing locks isn’t quickly arranged.

FAQs: Buying Sub $100k Foreclosures

Here are answers to some frequently asked questions about purchasing foreclosed homes under $100,000:

What hidden costs or fees should I budget for?

Expect extra expenses like past-due taxes/liens, HOA fees, property repairs, utility security deposits, financing costs, moving/storage, profit loss from flipping longer than planned.

How can I determine accurate property valuations?

Finding true market value info is tougher for foreclosures. Consult past tax assessments, neighborhood comps’ histories, multiple appraiser opinions to estimate appropriately.

Are auctions or REOs better for bargain deals?

Auctions create competitive bid environments that could inflate end-costs while REOs have set listing prices allowing room to negotiate, but less urgency motivating banks to lower numbers.

Should I tackle repairs myself or hire contractors?

Taking minor cosmetic updates on yourself saves money but contract out electrical, plumbing and complex ventures requiring expert skills, insurance policies protecting your investments.

What real estate agents specialize in foreclosures?

The best foreclosure buying agents understand local auction processes, investor rehabbing costs, and have strong ties for accessing bank-owned listings pre-market. Seek referrals from past clients on these experts.

Conclusion

In summary, foreclosures under $100K require research and vision, but are smart plays offering extreme homeowner savings if you strategize purchases wisely. Determining accurate property conditions, creatively financing deals, and timing your bidding approach are all key tactics setting you up for success buying foreclosure homes for 50-75% off full values. Partner with knowledgeable real estate agents and contractors to smoothly navigate fixer upper challenges. Roll up your sleeves and tackle necessary renovations or repairs yourself where possible as well. With some elbow grease and patience finding hidden gem deals, phenomenal sub $100K foreclosure steals awaiting make achieving homeownership dreams very feasible on restricted budgets.

]]>

Best States to Buy Rental Investment Property 2024

Real estate investors have historically relied on rental income properties to generate passive revenue and build long-term wealth. As national home values continue rising faster than wages, affordable investment options still exist for those with sufficient capital and savvy. We identified the top state markets poised to deliver positive cash flows in 2024 based on key predictive indicators.

How is 2024 Shaping Up for Rental Property Investors?

The US housing market enters 2024 on uncertain footing as the Federal Reserve battles stubborn inflation through aggressive rate hikes. With mortgage rates double 2021 levels now exceeding 6%, home affordability has plummeted back to 1990 levels. This affects real estate investors in two opposing ways:

1. Purchase Challenge – Higher borrowing costs to obtain loans make it harder to find cash flowing properties that justify acquisition costs and expenses. Investors with all cash or large down payments hold advantage.

2. Renter Demand – As first time homebuyers get priced out of ownership, demand increases for affordable single family rentals and mid-market apartments. Properly screened tenants help offset note rates.

The key is targeting locations where rental demand outpaces supply boosts without insane property valuations. Markets like Boise and Phoenix that exploded in recent years now suffer slowing migration and corrections. Savvy investors should hunt secondary cities offering stability.

What Drives the Best Rental Property Markets?

Best States to Buy Rental Investment Property 2024

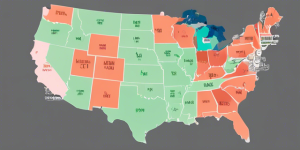

We assessed over 50 metrics across US cities and states to determine 2024’s optimal rental housing markets. Key selection criteria included:

- Low Unemployment – Employed tenants more likely to pay rents consistently

- ** Rising Wages** – Higher incomes support elevated rents to tenants and investors

- Affordable Pricing – Reasonable property values relative to rents in market

- Millennial Driven – America’s largest adult cohort needs apartments and first homes

- Business Friendliness – Employer and taxpayer friendly climates attract residents

- Future Growth – Economists predict above average expansion ahead

Markets excelling across these demand drivers should sustain smooth occupancy and cash flows for landlords. We also favored state income tax friendly locales for higher net yields.

Top 10 States to Buy Rental Properties 2024

Based on extensive market analytics, we predict these 10 states providing investors the best prospects to procure and profit from rental properties in 2024:

1. Tennessee

Major cities like Nashville and Memphis and smaller ones like Knoxville and Chattanooga feature prominent education and healthcare sector job creators. A popular southern destination for corporate expansions promises more growth ahead. Reasonable property valuations compared to rents persist, especially targeting Class B/C apartments and single family rentals.

Metro Nashville Area 2022 Rent Report

2. Florida

Always a migration magnet, Florida maintains immense appeal as baby boomers retire in droves to popular coastal metros. With no state tax income, Florida also attracts businesses. As single family and condo sales prices soar, rental demand for those unable to buy will heighten. Focus on neighborhoods near services and amenities.

Florida 2022 Rental Market Data

3. Texas

Ubiquitous job creation, especially in Houston and Dallas, accommodates Texas’ rapid population growth. Though home prices and property taxes have jumped in recent years, reasonable values can still be found in San Antonio, Fort Worth, suburban Houston and secondary markets. Avoid speculative plays.

Analysis of Texas Multi Family CRE Market

4. Georgia

Atlanta, Savannah and Augusta demonstrate solid fundamentals like employment and wage gains along with affordable pricing compared to other southeastern cities. Suburban Atlantan apartments, small multi-units and single family rentals should perform well attracting those priced out of owning.

Georgia Apartment Market Rent Forecast 2023

5. North Carolina

North Carolina’s research triangle region continues gaining high paying jobs as workers seek cheaper costs of living than adjacent Virginia and cities further northeast. Look for promising occupancy and rents around Charlotte, Raleigh, Durham and even tourism heavy Asheville as remote work trends persist.

Where are North Carolina Real Estate Markets Heading?

6. Ohio

Midwest affordability lures outsiders to Ohio metros like state capital Columbus, Cincinnati, Cleveland and Toledo. Healthy corporate environments, major universities and renown hospital systems should uphold employment and pay rates for in-demand renters as home prices outpace incomes in desirable neighborhoods.

Ohio Multi Family Commercial Real Estate Performance

7. South Carolina

Traditional value play Charleston continues gaining renown as a dining, arts and tech hub ideal for renters desiring southern charm. Upstate cities like Greenville, Spartanburg and Simpsonville display excellent quality of life to cost ratios. Avoid tourist dependent markets along the Grand Strand as seasonal volatility risk rises.

South Carolina 2023 Real Estate Market Predictions

8. Indiana

The Hoosier State lags its Midwest peer average for property value growth, positioning investors to secure relatively discounted assets in and around Indianapolis, Fort Wayne, Evansville, South Bend and Bloomington – home to Indiana University. Local landlords will benefit as talent stickiness rises.

Indiana Multi Family Market Shows Resiliency

9. Alabama

Fueled by growing aerospace and auto manufacturing presences spread across the state, Alabama delivers exceptional bang for the buck for real estate investors seeking double digit IRRs. Upward momentum should continue even if all markets moderate in 2024.

Birmingham Real Estate 2023 Forecast

10. Kentucky

Kentucky’s largest metro Louisville offers very reasonable single family rents relative to list prices despitesteady buyer demand. And the state’s business friendly policies attract ongoing corporate expansion and relocations providing tenant talent for landlords statewide.

Louisville Realtor Market Predictions 2023

Property Types Offering Top 2024 Returns

Best States to Buy Rental Investment Property 2024

We expect the following rental asset classes will deliver investors the highest risk-adjusted yields across our favored states this year based on various demand drivers:

Built For Rent Single Family

Private equity funds continue developing entire communities specifically for single family rental use given diminishing affordable for-sale housing inventory across suburban regions. Target metro fringes sporting household formation and income growth.

Class B Value Add Multifamily

Class A properties trading at premium valuations give Class B complexes opportunities to raise rents through interior and exterior facelifts post-acquisition. Priority metros hold high millennial concentrations needing affordable apartments.

Student Housing

While on campus dorms and luxury private accommodations overbuild in recent years, plenty of unrenovated properties near mid-sized universities offer turnaround potential as collegiate enrollments stabilize. Focus more on academics than athletics.

Secondary Market Upstarts

Look beyond the known major metro beneficiaries like Austin and Nashville seeking smaller yet similarly growing cities where asset inflation and regulations haven’t yet erased profit margins for operators and investors.

Blue Collar Single Family Rentals

Even modest 3 bedroom suburban homes with unfinished basements and privacy fenced back yards are becoming unaffordable for local first time buyers employed in lower paying service jobs. Their continued demand props up investment returns.

What to Avoid When Buying Investment Property

While dozens of markets major and minor exhibit positive demographic and asset trends for those acquiring rental housing in 2024, certain property situations remain more risky than advisable:

** Rural Markets**

Persistently negative net migration patterns into remote towns where economic opportunities are declining will fail to deliver tenant demand sufficient enough to offset operating costs and debt. Stick with growth instead of decline.

** Storm Impacted Coastlines**

Despite steep discounts on

properties damaged by recent hurricanes, avoiding additional catastrophe risk in coming years given climatologist predictions of intensifying storm systems makes better sense for conservative passive investors seeking sustainable yields.

** Overheated Appreciation Hubs **

Places like Boise and Phoenix that experienced exponential equity spikes in recent years based chiefly on inbound migration and institutional buying have corrected 20% or more and may further slide as demand retrenches faster than the supply catching up.

** Struggling Metro Office Markets**

Downtowns and urban cores dragged down by the combination of remote work adoption and recession risks should give investors pause as elevated vacancies in both commercial space and nearby apartments linger until reimagined revitalization initiatives gain traction.

** Unproven Alternative Assets**

While more adventurous investors might express interest in newly popular subsets like single family build-to-rent, fractional ownership, short-term furnished rentals or mobile home parks, most industry experts suggest waiting until successful precedents and business models become proven before pursuing.

How are Professional Investors Approaching 2024 Strategies?

In surveying top real estate investment trusts (REITs) and private equity firms who manage billions worth of US rental housing assets, we found most concentrating 2024 buying efforts on Sunbelt metros exhibiting jobs and migration momentum alongside still reasonable property valuations.

Especially alluring are secondary cities where housing affordability increasingly matters more as stock market volatility and recession worries make safety in cash flows paramount. Markets where high rents fully offset higher mortgage expenses should prevail regardless of purchase timing.

When seeking specific assets, those offering light interior cosmetic opportunities allowing operating expenses reductions and subsequent rent lifts are favored. Anything requiring heavy structural improvements or systems overhauls gets passed over for better baseline scenarios.

Investors also aim to retain existing property management infrastructure without interruption during acquisitions given talent shortages. No one wants vacancies occurring when demand still exceeds supply almost everywhere strategic buyers target.

What Due Diligence Should Investors Undertake?

Before committing capital to purchase rental housing in new markets, we advise obtaining objective third party perspective assessing critical assumptions made. Paying for unbiased data analysis and on the ground intelligence can either validate outlooks or reveal oversights.

Seeking local perspectives involves directly interfacing with key market constituents beyond transactions:

Brokers – Listing agents who deal in specific neighborhoods daily know the real demand dynamics, sale vs. list ratios and buyer overlap assuming tenancy or seeking it.

Property Managers – Those handling portfolios comparable to what an investor seeks possess tenant waitlists, turnover statistics and maintenance costs influences by climate and prevailing housing stock.

Employers – Economic development officials, corporate real estate VPs and site selection specialists provide market insight based on growth pursuits, industry initiatives and site planning.

Municipals – City planners, permit office managers, council members and county tax assessors explain present and future influences on housing costs, development plans, fees, taxes and regulations.

Contractors – Licensed general contractors familiar with target buy areas can detail construction material shortages, labor challenges, project timelines and overall cost trends for modeling assumptions.

Conclusion Key Takeaways

Markets offering rental property investors the best risk-adjusted returns share positive population and job growth fueling housing demand alongside relatively reasonable property valuations. These attributes allow landlords to push rents enough to offset rising financing and operating expenses.

Successful investors enter new markets only after thorough vetting of critical assumptions, tapping local sources beyond initial financial analyses. On the ground intelligence direct from brokers, property managers, employers, municipals and contractors provides objective validation or contraindication.

Getting 2024 rental investment decisions correct carries greater consequence given economic uncertainty on the horizon. Thoughtful planning and due diligence today lead to prosperity for years ahead.

Frequently Asked Questions

What is a good cap rate to target on rental property investments?

In today’s climate of rising borrowing costs and property values, investment target cap rates should be 5-6% minimum on value add to core plus apartment assets that allow for operational upside. Single family cap rates run slightly higher at 6 to 8%.

How many doors should real estate investors buy at once?

Portfolio size depends on one’s total investable capital and self-imposed portfolio concentration limits. Asses your risk tolerance. Buying individual long distance rental properties brings more onerous oversight than acquiring an entire multi-family complex ranging from 20 to 200 doors in the same metro area.

Are real estate investments safe if a recession hits?

Generally commercial and residential rental property withstands recessions better than other asset classes, although related construction and lending pauses. Difficulty refinancing debt presents some risk. Reasonably leveraged properties in growing metros with employed tenants should perform fine long run.

What prices and rents increases are expected in 2024? Home prices should rise around 5% given inflation and mortgage rates tempering demand. Multi-family rents could jump 7 to 9% while single family rents ascend 5 to 7% across our favored metro markets as incomes marginally rise but ownership affordability worsens driving rental demand.

When is the best time annually to close on investment property?

We prefer closing between November and February before peak leasing season begins allowing time to execute any prepping improvements or repairs necessary to secure optimal rents for coming 12 month cycle beginning in March through April across most US markets.

]]>

Affordable 55+ Retirement Communities in Florida

Florida is a top destination for retirees looking to enjoy warm weather year-round. With no state income tax and a lower cost of living than many other states, Florida can be an affordable place to retire. For adults 55 and over looking for an active social community, 55+ retirement neighborhoods provide access to amenities and peer connections without breaking the bank.

What Makes a Retirement Community “Affordable”?

Affordable 55+ Retirement Communities in Florida

Affordability is relative and depends on each retiree’s financial situation. We define affordable 55+ communities as those with home purchase prices and monthly fees below regional and national averages. Options range from manufactured home communities under $100,000 to apartment-style condos under $300,000. Monthly fees averaging $300-500 help maintain shared amenities.

Compared to other popular southern retirement destinations, Florida ranks among the most budget-friendly. States like North Carolina, Virginia, Georgia, and South Carolina have higher living costs overall. We compiled this guide to highlight Florida’s most economical 55+ retirement communities in scenic coastal and inland regions.

Top 10 Affordable Florida 55+ Retirement Communities

Affordable 55+ Retirement Communities in Florida

1. Solivita – Poinciana

Solivita is one of Florida’s top selling 55+ communities, offering an amenity-rich lifestyle at a reasonable cost. Home prices range from the $200s to $500s with condos and villas providing the most affordable options.

Average Monthly Fee: $235 Home Types: Single Family, Attached Villa, Condo Average Home Price: $350,000 Location: 25 miles south of Orlando

This gated community provides residents with access to seven clubhouses, dozens of pools, 200 activity clubs, and an award-winning fitness center. Solivita puts you close to Disney World without the resort prices.

2. Kings Point – Sun City Center

Kings Point is located within Florida’s largest retirement community, Sun City Center. Over 7,500 homes are available exclusively to buyers age 55 and older.

Average Monthly Fee: $145 Home Types: Villa, Manufactured Home Average Home Price: $150,000 Location: 30 miles south of Tampa

Home prices are some of the lowest among Florida retirement communities. Amenities include a community center with pools, dining venues, sports courts, dog parks, computer labs, and more.

3. Holiday Travel Park – North Fort Myers

Holiday Travel Park offers affordable resort-style living in southwest Florida. The gated community provides access to the Caloosahatchee River and Gulf beaches.

Average Monthly Fee: $470 Home Types: Manufactured Home

Average Home Price: $125,000 Location: 20 miles southeast of Fort Myers

Onsite amenities include a clubhouse, heated pools, shuffleboard, bocce ball, and laundry facilities. Home prices start under $100,000 making it one of Florida’s most budget-friendly over 55 communities.

4. Crystal Lake – Boynton Beach

Crystal Lake provides a laidback atmosphere with Florida’s sand and surf just minutes away. The pet-friendly community attracts active adults seeking affordability along the Atlantic coast.

Average Monthly Fee: $325 Home Types: Manufactured Home Average Home Price: $150,000 Location: 7 miles west of Boynton Beach

Community amenities include a clubhouse with an arts and crafts center, billiards, library, heated pool, and summer kitchen. Home costs are 50% below neighboring coastal communities.

5. Orange Blossom Hills – Spring Hill

Orange Blossom Hills offers reasonably priced manufactured home living north of Tampa. The gated community provides a range of activities and social events for adults 55 and older.

Average Monthly Fee: $420 Home Types: Manufactured Home

Average Home Price: $130,000 Location: 50 miles north of Tampa

Amenities include a 9,300 square foot clubhouse with a craft room, billiards, library, auditorium, fitness center, heated pool, and spa. Home resale prices start under $100,000.

6. Clearwater Cay – Clearwater

Clearwater Cay makes downtown Clearwater living affordable for older adults. The pet-friendly complex is located adjacent to Coachman Park and Tampa Bay.

Average Monthly Fee: $918 Home Types: Condo Average Home Price: $250,000 Location: Clearwater Beach Area

Amenities include a fitness room, library, heated pool, picnic area, and private 55+ events. Monthly costs are $200-300 below neighboring complexes. Home prices average at least $150,000 below nearby single family homes.

7. Colony Cove – Ellenton

Colony Cove offers economical golf course living along the Manatee River, minutes from the Gulf of Mexico. The pet friendly community attracts active adults with its selection of amenities.

Average Monthly Fee: $273 Home Types: Manufactured Home

Average Home Price: $125,000 Location: 20 miles south of Tampa

Community amenities include a 9,000 square foot clubhouse with pool, card rooms, shuffleboard, tennis, pickleball, and onsite golf. Home costs are among the lowest in the greater Tampa/Sarasota area.

8. Hometown America – St. Augustine

Hometown America provides affordable homeownership just off I-95 in St. Augustine. The pet-friendly neighborhood offers manufactured homes for under $150,000.

Average Monthly Fee: $500 Home Types: Manufactured Home Average Home Price: $140,000 Location: St. Augustine Area

Saltwater pools, shuffleboard, horseshoes, a fitness room, and clubhouse give residents plenty of room for activities. Below average purchase prices and fees make it a top value choice.

9. Sandpiper Cove – Cape Coral

Sandpiper Cove offers some of Cape Coral’s most affordable options for older adult living. The intimate neighborhood consists of 104 manufactured homes surrounding a shared amenities center.

Average Monthly Fee: $290 Home Types: Manufactured Home Average Home Price: $90,000 Location: Cape Coral

Onsite amenities include a heated pool, lounge area, laundry facility, and dock access to the Tarpon Canal. Home prices average $60,000 below neighboring communities.

10. Plantation – Crystal River

Plantation provides affordable homeownership along Florida’s Nature Coast. The age 55+ community gives residents access to Crystal River for boating, fishing, and kayaking.

Average Monthly Fee: $240

Home Types: Manufactured Home Average Home Price: $115,000 Location: Crystal River Area

Onsite amenities include a 12,000 square foot clubhouse with an arts and crafts room, dance hall, heated pool, shuffleboard, horseshoe pitching, and pickleball. Home prices average $70,000 below nearby private communities.

What Features Define Affordable Florida 55+ Communities?

To keep costs low, many affordable 55+ neighborhoods consist of manufactured or modular housing rather than traditional stick-built homes. These factory constructed homes can be 50% more economical. For those desiring condos or villas, seeking older communities with few to no developer units left can present values.

Most affordable communities have amenity centers smaller in scale than higher cost counterparts. You may find a modest clubhouse, one or two pools, a few sports courts, and surface parking rather than sprawling fitness centers, indoor pools, and garages. Programming and activity offerings may involve more self-direction than resort-style recreation departments.

While scaled down in certain areas, residents still have access to planned activities, peer connections, open space, and security features. Paying to wards the maintenance of shared amenities and services enables more budget-friendly home pricing. Finding the right balance comes down to aligning priorities with pricing.

Affordable 55+ Community Options?

We found the most economical values for 55+ living in these Florida regions:

Central Florida Central Florida presents outstanding affordability along with mild winters and low hurricane risk. Inland areas from Tampa to Daytona offer access to cities and beaches without heavy coastal price premiums. Top communities around Lakeland, Kissimmee, and Clermont start under $150,000.

North Florida The panhandle and northern Atlantic coast have warmer pricing than popular south Florida. Manufactured home parks and smaller condos developments fit more modest budgets. Values can be found around Tallahassee, Jacksonville, St. Augustine, and Gainesville.

Southwest Florida Affordable communities continue to emerge along Florida’s central Gulf coastline as the I-75 corridor develops. From Sarasota down to Fort Myers, numerous manufactured home parks and villa neighborhoods cater to 55+ buyers with amenities, social calendars, and budget pricing.

Southeast Florida South Florida remains the state’s most expensive region overall. However coastal markets like Vero Beach, Fort Pierce, and Boynton Beach offer scattered options relative to Miami. Less known inland towns have commuter access without seven-figure waterfront tags.

Within these broad regions, we recommend researching towns convenient to services, attractions, and essentials you value rather than remote areas. Balance affordability with accessibility as both gas and time have costs.

What Tradeoffs Come with Florida’s Most Affordable 55+ Communities?

While Florida’s cheapest active adult communities provide valued amenities and activities, certain tradeoffs exist to keep pricing low. Consider the following:

Home Quality – Prefab factory construction brings lower tags than custom built homes. Floorplans maximize value over size. Assess workmanship, materials, appliances and storage space.

Shared Walls – Condo, villas and manufactured houses often have close neighbor proximity and noise transfer issues. Review insulation ratings and community quiet hours.

Snowbird Dilution – Seasonal owner turnover can limit social cohesion and participation in covariates. Ask parks about owner occupancy rules and ratios.

HOA Health – Make sure the homeowners association or corporation has sufficient operating funds, adequate reserves, and proper insurance. Request financial statements.

Location Factors – Outlying counties offer cheaper taxes and costs but fewer services, dining, shopping and transport options. Weigh saved money against lost convenience.

Resell Challenges – Affordable communities don’t always attract resale buyers willing to pay escalated premiums compared to neighboring listings. Manage expectations on ROI.

Finding the right balance comes down to aligning amenities, atmosphere and expectations with pricing ranges. Conduct thorough due diligence before purchasing to make sure the community meets both current and future anticipated needs.

Tips for Getting the Best Deal on Florida 55+ Housing

These tips can help yield top value when purchasing a home in one of Florida’s many 55 and older communities:

Consider Resales First – Opt for resale homes over new developer units to avoid premium charges for inaugural phases. Also tour resales to inspect built product quality.

Compare Contract Terms – Review all association documents, bylaws, budgets, deeds, disclosures, and contracts before offer. Confirm fee breakdowns, reserve funding, owner protections and property use rights.

Negotiate List Price – While Florida’s market often favors sellers, room for price negotiation can open on units lingering past 60 days, in deferred maintenance condition, missing upgrades, or undesirable locations.

Query Incentives – Ask listing agents about any developer, county, utility or insurance incentives available to 55+ homebuyers. Look into mobility improvement tax breaks as well.

Upgrade Incrementally – Consider baseline homes that need cosmetic facelifts to control purchase budgets. Flooring, cabinetry, sinks and lighting all refresh easily over time. Focus on good bones and infrastructure.

Consult Tax Experts – Meet with an accountant or tax strategist familiar with senior relocations to Florida. Discuss exemptions, deductions, credits and filing advantages unique to older homeowners.

Lock Rates Early – Whether financing or buying outright, secure the best rates and terms available upon signing versus at closing. Shop multiple Florida lenders familiar with 55+ communities as pricing and requirements can vary.

Conclusion

Florida continues to offer the most affordable resort-style retirement living options in the southern United States. As developments expand with the state’s swelling senior population, economical 55+ communities have proliferated.

Retirees on modest budgets can balance home pricing and fees against community amenities, finding setups suitable to both lifestyle and financial needs. Compromise may come through smaller square footage, limited personal yard space or distance from attractions.

Thorough vetting allows buyers to assess tradeoffs. Partnering with a savvy real estate agent well versed in local values helps identify priority features to optimize pricing. For a stress-free transition into Florida 55+ living, align community selection with retirement time horizons, health outlooks and budget realities.

Frequently Asked Questions

What is considered an affordable home price for retirees in Florida? For a 55+ buyer on a fixed income under $4,000 monthly, we consider Florida homes affordable in the range of $150,000 to $350,000 depending on other living expenses. Condos and manufactured homes offer most economical options.

How much are HOA fees in Florida retirement communities? Average HOA fees range from $200 to $400 in affordable Florida retirement communities. High-end country clubs easily eclipse $1,000 monthly. Expect newly opened communities to have lower fees than well-established neighborhoods.

What Florida counties have the most affordable 55+ retirement communities? Sumter, Polk, Manatee and Pasco counties offer some of Florida’s most affordable 55+ living overall. Lesser developed areas tend to have lower home pricing, taxes and fees than coastal hotspots which carry premiums.

Are there special loans or mortgage programs for 55+ homebuyers? Yes, many lenders offer specific loan programs for 55+ borrowers that require lower down payments, use age as credit enhancement, and carry lower rates. Florida First Time Homebuyer programs apply to older adults moving from out of state.

Which neighborhood amenities are must-haves versus nice-to-haves? We consider a shared clubhouse, pool, postal facility and front gate security essentials for 55+ buyers. Nice-to-have amenities include gyms, tennis, bocce ball, pickleball, golf courses, walking trails, boat slips and craft rooms.

]]>

Becoming a First Time Landlord with Rental Property

Many people dream of owning investment properties and becoming landlords. And why not? Building rental income streams promises financial freedom. Yet, for first-timers, managing tenants and properties is often trickier than envisioned. Successfully jumping into land lording requires forethought, research, and preparation.

Your journey transitioning from homeowner to amateur landlord has just begun. Don’t worry, though—follow this guide to navigate key decisions with confidence as you wade into property management. Soon, you will comfortably reap rental rewards.

Clarifying Your Investment Goals

Before anything else, carefully consider why you want to buy rental real estate. Clearly defining goals and motivations will profoundly shape subsequent decisions, unit selection, financing options, and management approach.

For example, seek primarily passive income streams? Crave long-term equity accumulation? Want flexible retirement cash flow? Each objective suggests different ideal investments and landlording strategies. Once you clarify aims, identifying compatible properties becomes easier.

Choosing Where to Buy Rental Property

With goals set, now ponder location. Real estate markets vary tremendously, so study options matching aspirations.

Local or Out-of-State?

First decide whether to buy rentals locally or remotely. Both provide benefits.

Benefits of Local Investment Properties

Becoming a First Time Landlord with Rental Property

Owning nearby rentals simplifies hands-on landlording, allowing you to directly and quickly handle tenant issues, maintenance, unit upgrades, showings, etc. If looking to develop deep community ties through properties, local investing also eases relationship building.

Benefits of Out-of-State Investment Properties

Alternatively, purchasing remotely diversifies holdings across markets. You can capitalize on more favorable purchase costs, rents, taxes, and appreciation rates unavailable locally. Just ensure to vet property managers thoroughly if overseeing from afar.

Other Location Considerations

Also compare specific metro areas and neighborhoods on factors like:

- Rental demand – Seek lots of renter interest ensuring consistent occupancy

- Cash flow potential – Target markets offering optimal rent to price ratios

- Property value outlook – Choose reasonably priced areas poised for appreciation

- Infrastructure and amenities – Favor walkable communities near attractions

- Crime rates – Ensure neighborhood safety

- School district rankings – Top-rated districts command premium rents

- Local employer landscape – Growing major businesses bodes well for rental appeal

- Renovation costs – Lower upgrade expenses improve investment feasibility

Carefully weighing all location pros and cons will guide you towards prudent purchases.

Selecting the Right Rental Property Type

Beyond geography, also decide what kind of rental unit best aligns with your goals. Common first investments include single-family homes, condos/townhomes, duplexes, triplexes, or fourplex residences.

Key Differences Impacting Choices

Consider key variations across property types regarding:

- Affordability – Smaller multi-family buildings often cost less

- Earned rental income – More units equal more total rent

- Cash flow – Single-family rentals initially cash flow better

- Financing options – Lenders treat property types differently

- Maintenance costs – Individual houses typically cost more to upkeep

- Management workload – Multi-unit buildings take more oversight

- Tenant relationships – Interactions range from personal to businesslike

- Liquidity – Individual homes sell fastest typically

Carefully weighing tradeoffs will guide your investing plans.

Finding Good Rental Property Listings

Once clear on goals and target location/property types, the exciting search for potential listings begins. But where to look?

Working With Real Estate Agents

Seeking agent-listed properties makes sense for first-timers. Experienced realtors conveniently aggregate available homes meeting your criteria across area MLS databases. Agents also coordinate showings, negotiate offers, and handle contracts.

Tips for Finding a Good Real Estate Investment Agent

When selecting an agent, find specialists with deep investment property expertise regarding:

- Local markets – Seek market-specific insights on trends, rents, regulations, etc. Local veterans outperform remote mega-agents.

- Property valuations – Confirm extensive comp analysis skills accurately assessing fat profits

- Financing – Ask about landlord loans and secured financing like DSCR products

- Screening tenants – Ensure they understand tenant vetting best practices

- Landlording laws – Require legal insights regarding landlord-tenant relations

- Trustworthiness – Find earnest professionals committed fully to your success

Taking time to identify compatible, strategically-aligned agents with rental expertise pays dividends.

Researching FSBO Listings

In addition to agent listings, also consider for-sale-by-owner (FSBO) properties. FSBOs often sell below market value since owners avoid realtor commissions.

- Scour Craigslist, Zillow, social media groups, and physical yard signs for FSBOs.

- Vet these direct-from-seller deals especially carefully, using comparable sales data and professional inspections to confirm prices and condition.

- Be prepared to handle purchase paperwork and negotiations yourself without an agent’s guidance.

In the right circumstances, FSBOs make fantastic rental investments, enabling bargain buying.

Arranging Financing to Purchase Investment Property

With target properties identified, securing capital funding comes next. Fortunately, multiple landlord-friendly financing options exist beyond conventional mortgages.

Down Payments

Unlike primary home loans, rental property down payments may be as low as 5-15%. Government backed FHA loans require just 3.5% down. This enables first-time investors to enter markets with less cash.

Loan Types

Investor loans differ from standard home loans, coming in two main flavors:

Rental Mortgages

Whether FHA, VA, USDA or conventional loans, rental mortgages work much like primary residence loans. However, you must be qualified based on your existing income and debts. Rental income doesn’t directly impact loan qualification.

Commercial Investor Loans

Alternatively, commercial investor mortgages specifically factor rental property cash flow. These ”DSCR” (debt service coverage ratio) loans qualify you based on the property’s projected net income, meaning you can borrow more.

DSCR products also offer perks like lower down payments, 30-year fixed rates, and interest-only options. However, commercial loan qualification involves strict scrutiny of your landlording track record and rental profitability models.

Other Financing Options

Beyond standard mortgages, first-time landlords can also utilize:

- Hard money loans

- Home equity loans or lines of credit

- 401(k) / IRA funds

- Private money loans from investors

- Partnership structures to pool funds

Getting creative with financing alternatives enables more newbies to achieve ownership.

Preparing Rentals Before Listing: Renovations and Upgrades

Once purchasing your property, preparing it for tenants comes next. While move-in ready homes require little work beyond deep cleaning and maintenance, most investments need upgrades tailored to renters.

Cosmetic facelifts refresh drab or outdated finishes, while strategic enhancements maximize functionality. Follow these renovation best practices when prepping rentals:

Focus Efforts Strategically

Prioritize changes delivering maximum rental value boosts given budget constraints. For instance, avoid over-improving luxury kitchens in working-class neighborhoods.

Blend Essential and Aesthetic Upgrades

Curb appeal matters, but don’t overlook major systems, safety, accessibility, storage, and traffic flow. Find the sweet spot balancing dazzle with function.

Employ Durable Finishes

Opt for indestructible surfaces in high-wear areas: metal vs. wood cabinets, luxury vinyl vs. tile flooring, solid surface vs. laminate countertops. This saves future headaches.

Consider Universal Design Elements

Incorporate ADA-inspired features like zero-entry showers, lever handles, wide halls, low thresholds, and rocker light switches suiting guests of all abilities.

Check Local Property Condition Requirements

Research mandatory habitability rules, lead laws, fire codes, and required efficiencies governing legally rentable homes in your area before investing in renovations.

Attracting Great Tenants and Marketing Vacancies

With welcoming rentals ready to lease, filling vacancies with reliable long-term residents is the next crucial step. Consistent occupancy ensures smooth sailing for novice landlords. But enticing ideal tenants requires strategic marketing and vetting.

Creating Listings

First, craft compelling listings showcasing your property’s amenities and value. Trained agents can provide time-tested rental content templates to adapt. Be sure to splurge on professional photography.

Pricing Units Strategically

When establishing asking rents, research comparative units in the neighborhood, while factoring in property conditions, sizes, amenities, and target tenant profile. Price competitively to attract interest while optimizing ongoing cash flow. Consider offering discounted introductory rates to fill vacancies faster.

Listing Rentals Broadly

Post listings widely across platforms popular with local renters like Zillow, Apartments.com, and Craigslist. Use eye-catching descriptions highlighting amenities most important to tenants.

Promoting Vacancies Strategically

Boost online listings via targeted social media advertising. Geofence ads to surrounding neighborhoods. Leverage remarketing tools keeping your brand top-of-mind among prospective renters browsing listings in the area.

Preparing for Showings

Make an amazing first impression by keeping interiors spotless and staging key rooms. Ensure sufficient availability to give walkthroughs. Provide printed materials like FAQs, applications, leases, and showing feedback forms.

Vetting Tenants Carefully

Showings complete, thoroughly vet applicants before signing leases to avoid delinquent and destructive residents.

Required Renter Screening Protocol

Follow best practice screening involving:

- Background/credit checks assessing financial responsibility

- Employment and income verification ensuring adequate earnings

- Past landlord reference and rental history confirms responsible tenancy

- Full legal identification of all adult occupants

Digging Into Specifics

Probe screening results for potential issues regarding:

- Evictions and property damage history

- Bankruptcies or excessive debts relative to income

- Short job stints or employment gaps

- Large pet ownership, smoking, or other policy violations

- Criminal records involving violence, theft, or fraud

Weigh findings individually given unique contexts when making final tenant selections.

Signing Leases and Move-In Logistics

Upon final tenant approval comes lease execution and move-in coordination.

Ensuring Properly Structured Leases

Utilize binding lease agreements detailing party rights/responsibilities, rent rates/due dates, security deposits, maintenance designations, occupancy limits and all policies protecting you legally as landlord. Define breach protocols addressing issues from late payments to unauthorized guests. State specific tenant financial liabilities for damage repair.

Performing Rental Walkthroughs

Accompany new tenants do document pre-existing unit condition with photos/video on initial move-in. Log any prior wear like carpet stains or appliance dings. Review maintenance protocols and emergency contact procedures. Collect keys distributed.

Collecting Security Deposits

Gather standard first month rent plus full refundable security deposit upfront at lease signing. Typically equal to one month’s rent, security funds cover any unpaid dues or unit damages if tenants vacate improperly. Always provide proper payment receipts.

With ideal residents secured and moved in properly, the fun really starts as new landlord lifestyle commences!

Developing Systems for Ongoing Property Management

Congratulations, your investment property is officially rented! Now the day-to-day work maintaining properties while profiting begins. Be sure to:

Institute Regular Inspections

Perform periodic unit walkthroughs to validate responsible tenant care and identify emerging maintenance needs. Provide proper legally required entry notice beforehand. Incorporate annual/biennial inspections checking safety equipment and essential systems functionality.

Define Maintenance Protocols

Create systems governing how occupants should report issues and how you will coordinate both emergency and routine repairs using trusted providers. Be ultra-responsive to urgent fixes impacting tenant health or property integrity.

Cultivate Relationships

Make regular contact with friendly check-ins to monitor experience and changing needs. When possible, provide little conveniences like replacing furnace filters proactively or touching up scuffs for free. Such gestures foster community.

Implement Rent Payment Systems

Establish clear on-time monthly rent collection processes via direct bank transfers. Avoid cash payments. Quickly address non-payment according to lease policies. Annually adjust rents according market rates.

Maintain Detailed Records

Closely document all financial transactions, communications and unit activity for taxes and dispute mediation if ever necessary.

While arduous at times, honing such operational processes improves landlording efficiency greatly.

Evaluating Direct vs Outsourced Property Management

Especially when juggling multiple properties, consider whether to self-manage units or utilize a third-party rental property management service. Assess options.

Handling Everything Yourself

Self-managing maximizes rental revenue since no middleman fees deduct. Hands-on control enables establishing genuine tenant relationships through service. Execute upgrades and renovations per your exact specifications.

However, doing everything personally demands major time investments directly handling maintenance, advertising vacancies, screening applicants, chasing late rent, evictions, accounting, etc. Potentially risky unless extremely organized.

Hiring an Onsite Manager

For larger properties like multi-family buildings, onsite manager hires who live rent-free in exchange for handling operations are common. This delegates reliably to someone always available when tenant issues inevitably arise. Just split additional units to cover their compensation. Potential personality conflicts do loom though with live-in arrangements.

Using Third-Party Property Management Firms

Alternatively, experienced full-service property management companies oversee everything for around 10% of collected rents. They market listings, vet tenant applications, coordinate maintenance, direct lease renewals and more so owners enjoy truly passive income. However such help isn’t free or perfect. Reputations vary greatly across providers.

Weigh cost/benefit tradeoffs regarding your budget, portfolio scale and personal bandwidth when deciding between self-management and outsourcing. Hybrid approaches are also possible.

Preparing to Handle Challenging Tenant Situations

Even the most prudent preparation and strict tenant vetting cannot prevent occasional conflicts. Prepare professional protocols addressing difficult scenarios like:

Late Rent Payments

Have clear lease terms dictating precise late fee assessments after strict payment due dates, and required actions following protracted non-payment from firmly worded notices through to eventual needed evictions.

Unexpected Departures Mid-Lease

While security deposits discourage premature move-outs, be ready to aggressively remarket and fill vacancies should they occur unexpectedly. Also account for all funds owed through lease conclusion during final walkthroughs.

Unauthorized Occupants or Pets

Protect profitability and peace by quickly addressing unauthorized residents or pets discovered during inspections. Kindly refer to signed leasing contracts when asking offenders to vacate or remove pets. Serve formal notices as needed per local regulations.

Tenant Complaints About Conditions

Address authentic structural or system failures promptly. For suspect claims, conduct joint unit walkthroughs to demonstrate pristine conditions proving accusations false. Offer reasonable concessions to placate complainers.

Property Damage

When damage is reported/observed, investigate cause and coordinate professional repairs, billing validated expenses to tenant security deposits when warranted. In cases of extreme destruction, file insurance claims.

While staying constantly positive, also be prepared to firmly exercise full legal authority. Protect hard earned returns.

Leveraging Expert Guidance

Don’t go it alone! Cultivating trusted mentors accelerates success.

Finding an Accountant

A tax-saavy accountant specialized in landlord clients ensures fully optimized returns. Review filings together and discuss growth strategies for expanded holdings.

Working with Legal Counsel

Establish relations with a real estate attorney to consult regarding localized compliance, landlord-tenant law, lease standards, and liability considerations when issues arise.

Networking with Fellow Landlords

Join regional landlord associations to exchange ideas with veterans owning similar portfolios. Brainstorm solutions and cautionary tales about navigating tricky situations.

Surrounding yourself with skilled specialists ensures you avoid costly missteps when charting new territory.

Conclusion

While rentals offer alluring income streams, seamless landlording requires tireless effort, at least initially. But follow these guides to clarify goals, select properties in promising markets, fund deals advantageously, upgrade units strategically, market rentals effectively and manage operations smoothly. Over time, portfolios provided diversified passive earnings do materialize if you invest diligently. Soon you will enjoy the many rewards of maintaining properties for the benefit of others. Just take that first step—happy renting!

Commonly Asked Questions About Becoming a First Time Landlord

Below are answers to some frequently asked questions about starting out as a new landlord:

What are the main start-up costs for first-time landlords?

Key upfront costs typically include: down payments, closing fees, inspection/appraisal charges, financing costs, renovation & upgrade projects, staging, photography/marketing materials, legal fees, insurance policies, maintenance reserves, etc. Budget substantially to launch properly.

What legal protections exist for novice landlords?

Key legal provisions benefiting landlords include requiring detailed lease agreements outlining tenant responsibilities, collecting security deposits covering damages, adhering to entry notification laws, documenting property condition, following precise eviction protocols, small claims court options, housing discrimination prohibitions, etc. Know rights.

What are tenant red flags to watch for?

Beware applicants with prior evictions, collections/legal judgments against them, credit scores below 600, felony convictions, frequent past moves, incomplete rental histories, missing identification, pet policy violations or who resist standard

]]>

Home Improvement Grants for Elderly and Disabled

Elderly and disabled homeowners face unique challenges when it comes to maintaining and improving their homes. As we age, mobility becomes more difficult and completing routine household tasks like yardwork, cleaning gutters, and making repairs can be physically taxing or even hazardous. Fortunately, many government and nonprofit programs provide grants and funding opportunities specifically aimed at helping senior citizens and people with disabilities make necessary home modifications.

Types of Home Improvements Covered

Home Improvement Grants for Elderly and Disabled

There are grants available to help elderly and disabled homeowners make all kinds of upgrades and changes to their houses. Some of the most common home improvement projects funded include:

Accessibility Modifications

One major category of home improvements involves modifications like:

- Installing wheelchair ramps

- Widening doorways for wheelchair access

- Upgrading to larger showers and bathtubs

- Adding grab bars and handrails

- Improving lighting and floor surfaces

These changes help improve mobility and allow people to more easily and safely perform everyday tasks.

Health and Safety Upgrades

Grants can also help fund updates like:

- Fixing old electrical wiring

- Replacing heating and AC systems

- Improving insulation and weatherproofing

- Installing smoke detectors and alarms

- Eliminating fall hazards like loose carpeting

Such improvements enhance overall wellbeing and security.

Exterior and Structural Repairs

Finally, grants help homeowners afford major projects like:

- Re-siding and roof replacement

- Fixing porous foundations

- Rebuilding crumbling chimneys

- Repaving cracking driveways

- Pruning overgrown trees near the home

These exterior and structural repairs maintain the integrity of the home.

Common Providers of Home Improvement Grants

Home Improvement Grants for Elderly and Disabled

There are a few major sources that provide home improvement grants specially tailored to meet the needs of elderly and disabled residents.

Federal Government Grant Programs

Several federal agencies like the Department of Housing and Urban Development (HUD) and Veterans Affairs offer grants and low-interest loans for accessibility remodels and health-related upgrades. Most programs are income-based and give funding priority to low-income applicants.

State and Local Governments

In addition to federal options, many state housing agencies and city community development departments have special assistance funds for necessary home repairs. These programs help pick up where federal grants leave off and serve more middle-income elderly and disabled homeowners.

Nonprofit Organizations

Finally, various nonprofit groups and charities provide home improvement grants. For example, groups like Rebuilding Together, Habitat for Humanity, and The Home Depot Foundation partner with volunteers to assist elderly, disabled, and veteran homeowners with maintenance and repairs.

Eligibility Requirements for Home Improvement Grants

While specific eligibility rules differ across programs, most home improvement grants for elderly and disabled have a few general requirements:

Home Ownership

Nearly all programs require applicants to own and occupy the home needing repairs. Renters are generally not eligible.

Residency Status

Most grants require recipients to be permanent legal residents within the United States.

Financial Need

Since grants provide free financial assistance, applicants must demonstrate economic hardship and an inability to fund repairs alone. Specific income thresholds apply.

Age and Disability

Grant recipients must be elderly, defined as 60+ years old in most programs, or have a documented disability recognized by the Social Security Administration. Proof of age or disability is typically required.

Property Taxes and Insurance

Applicants also must have up-to-date property taxes and homeowner’s insurance to qualify for most programs. delinquent accounts or lack of insurance may disqualify applicants.

How to Apply for Home Improvement Grants

If you meet eligibility rules, follow these steps to seek home improvement funding:

Identify Needed Repairs

First, make a list of projects, getting contractor quotes for larger repairs. This helps estimate costs and clarify work required.

Research Available Grant Programs

Next, search for grants suited to your needs and eligibility. Catalog grant details like maximum awards, household income limits, and application deadlines.

Gather Required Documentation

You will need to submit items verifying identity, home ownership, age/disability status, income, residency, and insurance coverage. Start compiling needed paperwork.

Complete Applications Thoroughly

Follow all instructions carefully, accurately filling in each section. Supplement with required documents. Submit applications before specified deadlines.

Await Funding Decisions

Finally, grant administrators will contact you regarding award decisions and next steps. Funds may distribute directly to homeowners or contractors once work is approved.

While not guaranteed due to high demand, home improvement grants can make critical home repairs possible for older adults and people with disabilities struggling to manage expenses. With some research and planning, you can access these benefits.

Commonly Asked Questions About Home Improvement Grants for Elderly and Disabled

Below are answers to a few frequently asked questions about home improvement grant programs for elderly and disabled homeowners:

What Repairs Do the Grants Typically Cover?

Common projects funded by grants include wheelchair ramp and grab bar installation, doorway widening, kitchen/bath remodels improving accessibility, electrical and HVAC upgrades, exterior repairs like new roofs or siding, and more.

How Much Money Can I Get From a Home Improvement Grant?

Grant amounts vary greatly by program, from several hundred to tens of thousands of dollars. Budgets depend on factors like income level, repair extent, and funding availability. Many require homeowners to contribute a percentage toward project costs.

Where Does the Grant Money Come From?

Home improvement grants derive from government allocations, non-profit charitable giving, corporate philanthropic efforts, and other public/private partnerships aimed at assisting vulnerable elderly and disabled populations maintain safe, habitable housing.

What Restrictions or Rules Are Placed on How I Spend Grant Money?

Grant programs detail approved uses for awarded funds, typically limiting spending to pre-determined necessary repairs related to health/safety and accessibility. Work must also comply with state and local building codes and zoning laws. Strict oversight governs distribution from grantees to contractors.

How Can I Improve My Chances of Getting Approved for a Home Improvement Grant?

Tips for increasing odds of success include clearly detailing repair needs, getting multiple contractor estimates, gathering all required financial/demographic documentation, calculating precise project costs, demonstrating dire need, and having favorable credit/background checks. Also apply early, as some grants are first come, first served.

Conclusion

Maintaining and improving a home becomes increasingly difficult with age and disability. Fortunately home improvement grants ease the financial burden for vulnerable populations struggling with mobility limitations and fixed incomes. Multiple government, nonprofit and community assistance programs provide aid, prioritizing necessary repairs that allow elderly and disabled homeowners to preserve independence and remain living safely in their houses as long as possible.

If you or a loved one need help funding critical home modifications, research available grants, evaluate eligibility, and complete comprehensive applications. With persistence and planning, vital assistance is within reach, helping ensure your needs are met

]]>

Home Buying Assistance Programs for Veterans

Purchasing a home is a major financial commitment that can be challenging, especially for veterans on fixed incomes or with disabilities. Fortunately, there are various home buying assistance programs tailored specifically to service members, veterans, and their families. These programs make homeownership more accessible and affordable.

VA Loans