Navigating Financial Turbulence: Debt Relief Programs for Small Business Owners 2024

As a small business owner, you’ve poured your heart, soul, and resources into making your entrepreneurial dream a reality. However, even the most well-planned ventures can encounter unforeseen challenges and financial turbulence, leaving you grappling with mounting debt. In these trying times, it’s crucial to understand that you’re not alone, and there are various debt relief programs available to help steer your business back toward calmer waters.

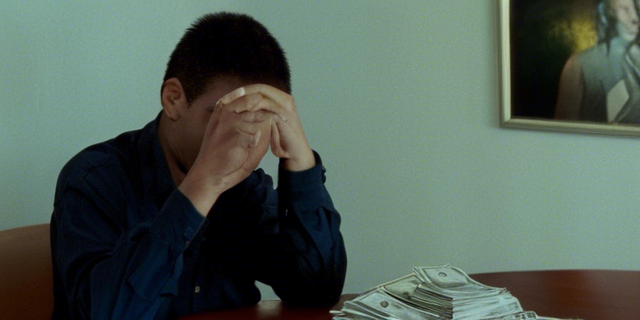

The Weight of Small Business Debt

Before delving into the debt relief options, let’s acknowledge the gravity of the situation. According to a report by the Federal Reserve Bank of New York, small businesses in the United States carry an average debt of $195,000, with nearly one-third owing more than $100,000. This financial burden can be crippling, hindering growth, stifling innovation, and threatening the very existence of your hard-earned enterprise.

Option 1: Small Business Debt Restructuring

One of the first steps in finding relief from overwhelming debt is to explore debt restructuring options. This process involves renegotiating the terms of your existing loans or credit agreements with lenders, potentially reducing interest rates, extending repayment periods, or restructuring the debt into more manageable installments.

Debt restructuring can be initiated through direct negotiations with your lenders or with the assistance of a third-party debt relief service. Organizations like the National Foundation for Credit Counseling (NFCC) and the Association of Independent Consumer Credit Counseling Agencies (AICCCA) offer debt management programs tailored specifically for small businesses.

Option 2: Small Business Debt Consolidation

If you’re juggling multiple debt obligations, debt consolidation may be an effective strategy to streamline your payments and potentially secure more favorable terms. This approach involves taking out a new loan or line of credit to pay off existing debts, consolidating them into a single monthly payment.

Popular debt consolidation options for small businesses include:

- Small Business Administration (SBA) loans: The SBA offers various loan programs, including the 7(a) loan program, which can be used for debt consolidation purposes.

- Business line of credit: A line of credit from a bank or alternative lender can provide access to funds for consolidating and restructuring debt.

- Debt consolidation loans: Some lenders specialize in debt consolidation loans specifically designed for small businesses.

When considering debt consolidation, carefully evaluate the terms, interest rates, and fees to ensure that the consolidated loan offers a tangible benefit over your existing debt obligations.

Option 3: Small Business Bankruptcy

In cases of severe financial distress, small business owners may need to explore the option of bankruptcy. While the prospect of bankruptcy can be daunting, it’s important to understand that it’s a legal mechanism designed to provide a fresh start and a path to financial recovery.

For small businesses, the most common types of bankruptcy are:

Chapter 7 Bankruptcy

Also known as “liquidation bankruptcy,” Chapter 7 involves the sale of non-exempt business assets to pay off creditors. Any remaining eligible debts are then discharged, providing the business owner with a clean slate. However, this process typically results in the dissolution of the business.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy, also referred to as “reorganization bankruptcy,” allows the business to continue operating while restructuring its debts and reorganizing its financial affairs under the supervision of a bankruptcy court. This option is often more complex and expensive but can provide a path to continued operations for viable businesses.

It’s crucial to consult with an experienced bankruptcy attorney to understand the implications, eligibility requirements, and potential consequences of filing for small business bankruptcy.

Option 4: Alternative Lending Solutions

In recent years, alternative lending solutions have gained traction as a viable option for small businesses seeking debt relief. These lenders operate outside the traditional banking system and often offer more flexible terms and faster approval processes.

Some alternative lending solutions for small business debt relief include:

- Merchant cash advances: These short-term funding solutions provide an upfront lump sum in exchange for a percentage of future sales or revenue.

- Online business lenders: Companies like Kabbage, OnDeck, and Funding Circle offer various loan products tailored to small businesses, including debt consolidation and refinancing options.

- Crowdfunding platforms: Platforms like Kickstarter and Indiegogo allow small businesses to raise funds from a broad base of supporters, potentially alleviating debt burdens.

While alternative lending solutions can provide quick access to capital, it’s crucial to carefully evaluate the terms, fees, and repayment structures to ensure they align with your business’s financial goals and capabilities.

Option 5: Negotiating with Creditors

In some cases, directly negotiating with creditors can be an effective approach to securing more favorable repayment terms or even debt forgiveness. This strategy involves open and honest communication with your creditors, outlining your financial situation, and proposing a mutually beneficial solution.

Successful creditor negotiations often involve:

- Requesting interest rate reductions or temporary interest relief

- Negotiating for extended repayment periods or reduced monthly payments

- Exploring debt settlement options, where a lump sum is offered as partial payment of the outstanding debt

It’s important to approach these negotiations with a well-prepared plan, documented financial statements, and a willingness to compromise. Additionally, be sure to obtain any agreements in writing to avoid future misunderstandings or disputes.

Option 6: Seek Professional Guidance

Navigating the complexities of small business debt relief can be overwhelming, especially when faced with the pressures of daily operations and strategic decision-making. In such situations, seeking guidance from professionals can be invaluable.

Consider consulting with:

- Certified Public Accountants (CPAs): CPAs can provide valuable insights into your financial situation, assist with debt restructuring negotiations, and advise on tax implications.

- Business attorneys: Experienced business attorneys can guide you through the legal intricacies of debt relief options, including bankruptcy proceedings and creditor negotiations.

- Business consultants: Consulting firms specializing in small business turnarounds and debt management can offer strategic guidance and customized solutions tailored to your specific needs.

While professional guidance may come at a cost, the potential benefits of avoiding costly mistakes and securing the most favorable debt relief solution can often outweigh the upfront investment.

Option 7: Government-Backed Relief Programs

During times of economic uncertainty or widespread crises, various government-backed relief programs may become available to support small businesses. These programs can take various forms, such as loan forgiveness initiatives, tax relief measures, or direct financial assistance.

For example, during the COVID-19 pandemic, the U.S. government introduced the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL) to provide financial relief to struggling small businesses.

It’s essential to stay informed about available government-backed relief programs and actively explore eligibility requirements and application processes. Organizations like the Small Business Administration (SBA) and local business development centers can be valuable resources for accessing these programs.

Option 8: Debt Settlement Companies

For small business owners overwhelmed by the complexities of debt negotiations, debt settlement companies can provide a streamlined solution. These companies act as intermediaries, negotiating with creditors on your behalf to settle outstanding debts for a reduced lump sum payment.

While the services of debt settlement companies can be convenient, it’s crucial to exercise caution and thoroughly research their reputation, fees, and success rates. Some disreputable companies may engage in unethical practices or charge exorbitant fees, potentially exacerbating your financial situation.

When considering debt settlement companies, seek recommendations from trusted sources, read reviews, and carefully review the terms and conditions before engaging their services.

Option 9: Asset Liquidation or Downsizing

In cases where debt relief is paramount, small business owners may need to explore the option of liquidating non-essential assets or downsizing operations. This approach involves selling off underutilized or non-core assets, such as equipment, inventory, or real estate, to generate funds for debt repayment.

Downsizing operations, such as reducing staff or closing underperforming locations, can also help alleviate financial burdens and redirect resources towards debt relief efforts.

While asset liquidation and downsizing can be difficult decisions, they may be necessary steps to secure the long-term viability of your business and preserve its core operations.

Option 10: Exploring New Revenue Streams

In addition to debt relief strategies, exploring new revenue streams can provide a much-needed infusion of capital to support your business’s financial recovery. Consider diversifying your product or service offerings, expanding into new markets, or leveraging digital platforms to reach a broader customer base.

Entrepreneurial creativity and agility can be powerful allies in overcoming debt challenges. By identifying untapped revenue opportunities and implementing strategic growth initiatives, you can potentially generate the funds required to tackle your debt obligations more effectively.

Option 11: Business Restructuring or Strategic Partnerships

For some small businesses, restructuring operations or forming strategic partnerships may be the key to alleviating debt burdens and positioning the company for long-term success.

Business restructuring can involve reorganizing departments, streamlining processes, or pivoting to a more sustainable business model. This approach aims to reduce operational costs and increase profitability, freeing up resources for debt repayment.

Strategic partnerships, such as joint ventures, licensing agreements, or mergers, can provide access to new markets, shared resources, and complementary expertise. These collaborations can potentially generate new revenue streams and operational efficiencies, enhancing your ability to manage debt obligations.

Option 12: Debt Relief and Credit Counseling Services

When the weight of debt becomes overwhelming, seeking professional guidance from debt relief and credit counseling services can be a valuable resource. These organizations provide personalized advice, debt management plans, and negotiation assistance tailored to the unique needs of small businesses.

Services offered may include:

- Debt analysis and budgeting: Comprehensive assessment of your financial situation and development of a realistic budget and repayment plan.

- Creditor negotiations: Experienced counselors can negotiate with creditors on your behalf to secure more favorable repayment terms or debt settlements.

- Credit counseling: Guidance on improving your business credit score, managing credit utilization, and establishing healthy credit habits.

- Financial education: Educational resources and workshops to enhance your financial literacy and prevent future debt challenges.

While working with debt relief and credit counseling services may involve fees, the potential savings and peace of mind they offer can be well worth the investment.

Option 13: Business Mentorship and Support Networks

Navigating the challenges of small business debt can be a lonely and isolating experience. However, seeking support from experienced mentors and engaging with like-minded business communities can provide invaluable guidance, encouragement, and practical insights.

Business mentors can share their hard-earned wisdom, offering advice on debt management strategies, operational efficiency, and personal perseverance. These mentors may be found through local business organizations, entrepreneurship programs, or online networks.

Additionally, joining small business support groups or online forums can connect you with a community of entrepreneurs facing similar struggles. These networks can provide a safe space to share experiences, seek advice, and find strength in collective resilience.

Option 14: Prioritizing Mental Health and Self-Care

The weight of small business debt can take a significant toll on your mental and emotional well-being. It’s crucial to prioritize self-care and maintain a healthy mindset throughout the debt relief process.

Consider seeking professional counseling or joining support groups to help manage stress, anxiety, and potential burnout. Engaging in regular exercise, mindfulness practices, or creative outlets can also provide much-needed respite and rejuvenation.

Remember, your mental and physical health are inextricably linked to the success of your business. By prioritizing self-care, you’ll be better equipped to navigate the challenges of debt relief with clarity, resilience, and a renewed sense of purpose.

Option 15: Embracing Entrepreneurial Resilience

Overcoming small business debt is not merely a financial challenge; it’s a test of entrepreneurial resilience. It’s during these trying times that your determination, adaptability, and unwavering commitment to your vision will be put to the ultimate test.

Embrace the lessons learned from this experience, and let them fuel your growth as a business leader. Reflect on the strategies that contributed to the accumulation of debt, and commit to implementing more robust financial management practices moving forward.

Remember, entrepreneurship is a journey filled with obstacles and setbacks, but it’s also a testament to the indomitable human spirit. By navigating the debt relief process with courage, creativity, and a steadfast belief in your vision, you’ll emerge stronger, wiser, and better equipped to tackle the challenges that lie ahead.

Conclusion

The journey of a small business owner is never without its challenges, and grappling with debt can be one of the most formidable obstacles you’ll face. However, by exploring the various debt relief options outlined in this guide, you can take proactive steps towards regaining financial stability and securing the long-term success of your entrepreneurial endeavor.

Remember, seeking debt relief is not a sign of failure but rather a strategic decision to overcome temporary setbacks and position your business for a brighter future. Embrace the support of professionals, leverage available resources, and remain steadfast in your commitment to your vision.

The road ahead may be winding, but with determination, resilience, and a commitment to continuous learning, you can navigate these financial turbulences and emerge as a stronger, more seasoned business leader, ready to soar to new heights of success.

FAQs

1. Can small business debt relief programs impact my personal credit score?

Yes, certain debt relief options for small businesses, such as bankruptcy or defaulting on personal guarantees, can have a negative impact on your personal credit score. It’s essential to carefully evaluate the potential consequences of each option and seek professional guidance to mitigate any adverse effects on your individual creditworthiness.

2. What happens if I default on my small business loans?

Defaulting on small business loans can have severe consequences, including legal action from creditors, asset seizure, and potential personal liability if you provided personal guarantees. It’s crucial to explore all available debt relief options and negotiate with lenders before defaulting becomes a reality.

3. Can I maintain control of my business during a Chapter 11 bankruptcy reorganization?

In many cases, small business owners can retain control of their operations during a Chapter 11 bankruptcy reorganization. However, a bankruptcy trustee will be appointed to oversee the restructuring process and ensure compliance with court orders and creditor obligations.

4. Are there any tax implications associated with small business debt relief?

Depending on the specific debt relief option chosen, there may be tax implications to consider. For example, forgiven or settled debts may be considered taxable income, and asset liquidations may trigger capital gains taxes. It’s advisable to consult with a tax professional to understand the potential tax implications and plan accordingly.

5. What is the impact of seeking small business debt relief on my ability to secure future financing?

Seeking debt relief, particularly options like bankruptcy or debt settlement, can negatively impact your ability to secure future financing or credit lines. However, by consistently rebuilding your business credit and demonstrating responsible financial management, you can gradually regain credibility with lenders over time.