Can You Deduct Student Loan Interest on Your Taxes?

Paying back student loans can be a financial burden that lasts for years. With the average 2019 graduate owing over $30,000 in student debt, any help is welcome. One way to reduce your student loan costs is by deducting the interest you pay on certain federal and private student loans when filing your tax return. Utilizing this deduction can save you hundreds of dollars each year. But not everyone qualifies for the maximum student loan interest deduction, and understanding the eligibility rules is key to claiming this tax break correctly.

What is the Student Loan Interest Deduction?

The student loan interest deduction allows you to reduce your taxable income for the interest you paid in the tax year towards eligible federal and private student loans. For 2022 taxes, you can deduct up to $2,500 in student loan interest paid. While not a huge amount compared to the full loan balance, every dollar helps chip away at debt.

This deduction directly reduces your taxable income, allowing qualified taxpayers to retain more of their hard-earned money rather than owing it to Uncle Sam. The deduction is taken “above the line”, meaning you can claim it even if you don’t itemize deductions on Schedule A.

How Much Can I Potentially Deduct?

The maximum student loan interest deduction is:

- 2022 taxes – $2,500

- 2023 taxes – $2,500

So if you paid $2,800 in student loan interest in 2022, you can only deduct $2,500 of that amount. Any interest above the limit cannot be claimed.

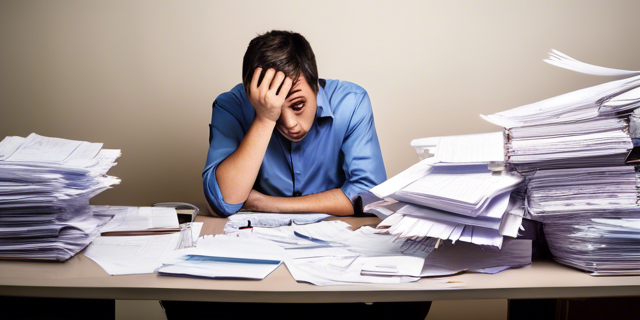

Am I Eligible To Deduct My Student Loan Interest?

Knowing the eligibility requirements for the student loan interest deduction is crucial to avoid problems. While many people with loans seem automatically entitled to the tax break, unfavorable restrictions do exist.

Income Limits

Only taxpayers under these Modified Adjusted Gross Income (MAGI) limits can deduct student loan interest:

- 2022 taxes: $85,000 if single, $175,000 if married filing jointly

- 2023 taxes: $85,000 if single, $175,000 if married filing jointly

For example:

- Mark filed his 2022 taxes as single with a MAGI of $90,000. He is not eligible for the student loan interest deduction because his income exceeds $85,000.

- Maria filed jointly with her husband for 2022 taxes. Their MAGI is $150,000. Because their joint income falls under $175,000, Maria is eligible for the deduction.

If your MAGI surpasses the thresholds, even by one dollar (e.g. $85,001 single), you cannot claim any deduction. Consider lowering your MAGI if possible to qualify.

Qualifying Loans

Only student loans taken solely to pay qualified higher education expenses are eligible. This includes:

- Tuition and fees

- Room and board

- Books, supplies and equipment

- Other necessary expenses (transportation)

Federal student loans typically qualify, such as:

- Direct Subsidized/Unsubsidized Loans

- Parent PLUS Loans

- Graduate PLUS Loans

- Perkins Loans

- Consolidation Loans

Most private student loans also qualify. Features that determine eligibility include:

- Loaned money solely used for qualified higher education expenses

- Borrower must be legally obligated to make interest payments

- Lender cannot be a related person

- No tax-exempt private activity bonds financed the loan

The IRS provides specifics on eligible student loans. Refer to the loan document or contact your lender with questions.

How Do I Calculate And Claim The Deduction?

Claiming the student loan interest deduction involves a few key steps:

1. Determine Total Interest Paid

Add up 2022 interest payments made towards eligible federal and private student loans. This includes:

- Loan statements listing interest charged

- Form 1098-E if received from lenders

- Online account transaction histories

Tally amounts paid across multiple loans. For loans with combined principal/interest payments, request breakdowns from the lender.

Note: Only count interest actually paid in 2022, not the amount accrued.

2. Calculate Maximum Possible Deduction

Compare your total 2022 student loan interest paid from Step 1 to the $2,500 maximum deduction limit for 2022.

If greater than $2,500 – Your maximum deduction is $2,500.

If less than $2,500 – Your maximum deduction matches your interest paid.

You cannot deduct more than what you actually paid in interest or the limit if you had over $2,500.

3. Determine If You Qualify Based on Income

Review if your MAGI falls below the 2022 income limits:

- Single – $85,000

- Married Filing Jointly – $175,000

If your MAGI exceeds the thresholds even slightly, you cannot claim the deduction at all.

4. Claim Deduction on Form 1040

Form 1040 Schedule 1 is filed with your federal tax return to report adjustments to income, including the student loan interest deduction.

Line 21 of Schedule 1 is where you calculate and enter your maximum eligible deduction amount from Steps 1-3 above. This directly lowers your taxable income shown on Form 1040.

Save records proving interest payments in case the IRS audits.

5 Benefits Of The Student Loan Interest Deduction

Utilizing this adjustment helps borrowers in several ways:

1. Lowers Taxable Income

The deduction reduces your taxable income reported to the IRS. This could bump you into a lower tax bracket, saving money.

2. Allows You To Keep More Money

Less taxes owed means more funds stay in your pocket. This excess money can then pay down debt or other priorities.

3. Easy To Claim

Filing Schedule 1 is straightforward when completing annual taxes. The deduction also stays separate from itemizing.

4. Repeated Annual Savings

The deduction applies yearly to taxpayers who qualify. Interest payments often continue for a decade or longer after graduation, allowing for cumulative tax reductions.

5. Incentivizes Paying Loans

The policy motivates financially-strapped borrowers to keep chipping away at debt to realize deductions instead of defaulting. Even small wins help.

Common Questions

Still have questions about deducting your student loan interest? Here are answers to frequent inquiries:

Can I deduct interest paid on behalf of my child?

No. Only the person legally obligated to make payments on the student loan qualifies. So if you pay interest on a Parent PLUS Loan or private loan under your child’s name only they can claim the deduction.

What if loan payments are deferred?

Borrowers in deferment or forbearance who make interest-only payments can still deduct up to $2,500 of interest paid towards eligible federal or private student loans.

Can I deduct principal payments?

No, principal payments do not qualify for deductions, only interest. Paying down your overall loan balance still saves money long-term by reducing total interest costs.

Can I deduct student loan payments towards a relative’s loan?

You cannot deduct interest paid on another person’s student loans, including a spouse or child. There is no such thing as a “gift deduction.” Only the borrower legally obligated to make the loan payments can potentially claim the tax break.

How do I optimize deductions if married filing separately?

For married joint filers, consider amending returns to married filing separately status if your combined MAGI exceeds limits. This allows at least one spouse to potentially stay eligible income-wise. However, ensure the tax difference makes this switch worthwhile.

Conclusion

The student loan interest deduction allows eligible borrowers paying back federal and private student loans for higher education to reduce their tax burden. Understanding critical qualification factors like income limits, qualifying loans, and calculation steps ensures properly claiming this adjustment. Deducting up to $2,500 in interest paid can translate to significant tax savings each year. So review your eligibility and be sure to take advantage of this deduction if you qualify. Every dollar counts when paying back student debt.