Mastering the Art of Debt Freedom: Best Strategies for Reducing Credit Card Debt 2024

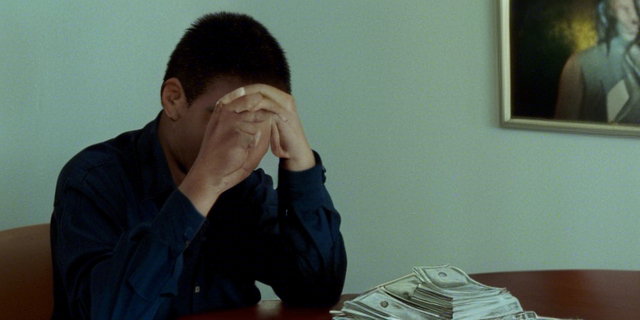

Drowning in credit card debt can feel like an overwhelming burden, leaving you trapped in a never-ending cycle of minimum payments and mounting interest charges. However, with the right strategies and a commitment to financial discipline, you can break free from the shackles of credit card debt and regain control over your finances. In this comprehensive guide, we’ll explore the best strategies for reducing credit card debt, empowering you to take charge of your financial future.

Understanding the Root Causes of Credit Card Debt

Before we dive into the strategies, it’s crucial to understand the root causes of credit card debt. More often than not, excessive spending, unexpected emergencies, or a lack of financial management skills contribute to the accumulation of debt. By identifying and addressing these underlying factors, you can prevent future debt from spiraling out of control.

Strategy 1: The Debt Snowball Method

The debt snowball method, popularized by financial guru Dave Ramsey, is a psychological approach that focuses on paying off your smallest debt first. Here’s how it works:

- List all your debts from smallest to largest, regardless of interest rates.

- Make minimum payments on all debts except the smallest one.

- Allocate as much money as possible toward the smallest debt until it’s paid off.

- Once the smallest debt is eliminated, roll over the payment amount to the next smallest debt.

- Repeat the process until all debts are paid off.

This method provides a sense of accomplishment as you quickly eliminate smaller debts, building momentum and motivation to tackle the larger ones.

Strategy 2: The Debt Avalanche Method

The debt avalanche method is a more mathematical approach that focuses on paying off the debt with the highest interest rate first. By targeting the most expensive debt, you can save significantly on interest charges in the long run. Here’s how it works:

- List all your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate as much money as possible toward the debt with the highest interest rate.

- Once the highest-interest debt is paid off, roll over the payment amount to the next highest-interest debt.

- Repeat the process until all debts are eliminated.

While this method may not provide the same psychological boost as the debt snowball, it can save you more money in interest charges over time.

Strategy 3: Balance Transfer to a Low-Interest Credit Card

If you have good credit, you may be able to transfer your high-interest credit card balances to a new card with a low introductory interest rate. This strategy can provide temporary relief from high interest charges, giving you breathing room to pay down the principal faster.

When considering a balance transfer, look for cards with:

- 0% introductory APR for at least 12-18 months

- Low or no balance transfer fees

- A plan to pay off the entire balance before the introductory period ends

It’s important to note that you should avoid using the new card for additional purchases, as this can derail your debt repayment plan.

Strategy 4: Debt Consolidation Loan

A debt consolidation loan allows you to combine multiple credit card balances into a single, fixed-rate loan. This strategy can simplify your payments and potentially lower your overall interest rate, making it easier to manage your debt repayment.

When considering a debt consolidation loan, research lenders that offer:

- Fixed interest rates lower than your current credit card rates

- Reasonable loan terms (typically 3-5 years)

- No prepayment penalties, allowing you to pay off the loan early

Be cautious of companies offering debt consolidation services that require upfront fees or have hidden costs, as these can further exacerbate your financial situation.

Strategy 5: Negotiate with Credit Card Companies

In some cases, you may be able to negotiate with your credit card companies for lower interest rates or more favorable repayment terms. This approach can be particularly effective if you’ve experienced a financial hardship or have a strong history of on-time payments.

When negotiating with credit card companies, consider the following tips:

- Be honest about your financial situation and express your willingness to pay.

- Request a lower interest rate or a temporary interest rate reduction.

- Ask for a waiver or reduction of late fees or over-limit charges.

- Propose a realistic repayment plan that fits your budget.

- Get any agreements in writing before making payments.

Remember, credit card companies are often willing to work with customers who demonstrate a genuine commitment to repaying their debts.

Strategy 6: Seek Professional Help

If your credit card debt has become overwhelming and you’re struggling to manage it on your own, consider seeking professional help. Credit counseling agencies and nonprofit debt management organizations can provide valuable guidance and assistance in developing a personalized debt repayment plan.

When seeking professional help, look for organizations that:

- Are accredited and have a good reputation

- Offer free or low-cost initial consultations

- Provide a range of services, including budgeting advice and debt management plans

- Have certified and experienced counselors

Be wary of for-profit debt settlement companies that make promises that seem too good to be true, as these can often lead to more financial harm in the long run.

Implementing a Comprehensive Approach

While each of these strategies can be effective on its own, combining multiple approaches can accelerate your debt repayment progress. For example, you could utilize a balance transfer to a low-interest credit card while simultaneously implementing the debt snowball or avalanche method.

Additionally, it’s crucial to adopt a lifestyle of financial discipline by:

- Creating a realistic budget and sticking to it

- Reducing unnecessary expenses and cutting back on discretionary spending

- Increasing your income through side hustles or freelance work

- Building an emergency fund to avoid relying on credit cards for unexpected expenses

By taking a comprehensive approach and committing to long-term financial discipline, you can not only eliminate your credit card debt but also establish a solid foundation for a debt-free future.

Conclusion

Reducing credit card debt requires a combination of strategy, discipline, and perseverance. By implementing the strategies outlined in this guide, you can regain control over your finances and break free from the burden of credit card debt. Remember, the journey may be challenging, but the reward of financial freedom is well worth the effort. Stay focused, stay motivated, and celebrate each milestone along the way.

FAQs

1. What’s the difference between the debt snowball and debt avalanche methods?

The debt snowball method focuses on paying off debts from smallest to largest, regardless of interest rates, providing psychological motivation. The debt avalanche method targets debts with the highest interest rates first, potentially saving more money on interest charges in the long run.

2. Should I close my credit card accounts after paying them off?

It’s generally advisable to keep your oldest credit card accounts open, as closing them can negatively impact your credit score by reducing your credit history and available credit. However, consider closing newer accounts or those with high annual fees.

3. Can I negotiate with credit card companies myself, or do I need a professional?

You can certainly try to negotiate with credit card companies yourself, especially if you have a good payment history and can clearly explain your financial situation. However, if you’re struggling to make progress or feel overwhelmed, seeking professional help from a credit counseling agency can be beneficial.

4. How long does it typically take to pay off credit card debt?

The timeline for paying off credit card debt depends on various factors, such as the total amount owed, interest rates, and the amount you can allocate toward payments each month. With discipline and a solid repayment plan, it’s possible to become debt-free within 3-5 years for many individuals.

5. What’s the impact of credit card debt on my credit score?

Credit card debt can negatively impact your credit score, especially if you’re carrying high balances relative to your credit limits (high credit utilization ratio). Consistently making on-time payments and reducing your outstanding balances can help improve your credit score over time.