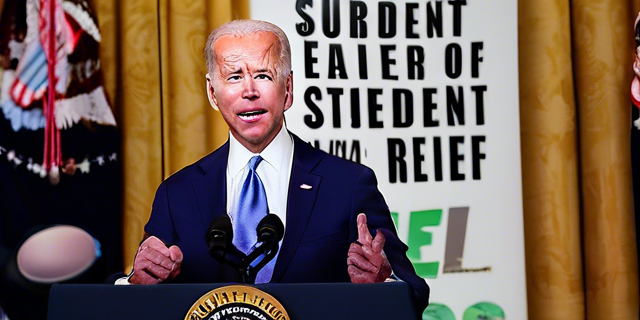

Biden Student Loan Relief 2024

In a move that has sent shockwaves through the academic and financial landscapes, President Joe Biden has announced a sweeping student loan relief plan that aims to provide much-needed assistance to millions of Americans struggling under the weight of their educational debts. This landmark decision, which has been hailed by some as a game-changer and criticized by others as an overreach of government power, has sparked a passionate nationwide debate.

The Backstory: Understanding the Student Debt Crisis

To fully appreciate the significance of Biden’s student loan relief plan, it’s essential to first examine the broader context of the student debt crisis in the United States. Over the past few decades, the cost of higher education has skyrocketed, far outpacing the growth of household incomes and leaving countless individuals saddled with overwhelming financial burdens.

According to the Federal Reserve, the total outstanding student loan debt in the United States currently stands at a staggering $1.7 trillion, with an average debt of $32,000 per borrower. This debt has not only impacted the financial well-being of individuals but has also had far-reaching consequences on the economy, as high levels of student loan payments can limit consumer spending, hinder home ownership, and delay major life milestones.

Biden’s Student Loan Relief Plan: The Key Elements

Against this backdrop, President Biden’s student loan relief plan aims to provide meaningful assistance to millions of Americans. The plan’s primary components include:

1. Debt Cancellation

The centerpiece of Biden’s plan is the forgiveness of up to $20,000 in federal student loan debt for eligible borrowers. Individuals with federal student loans who earned less than $125,000 (or couples filing taxes jointly who earned less than $250,000) in 2020 or 2021 will be eligible for this debt relief.

2. Extension of the Pause on Loan Payments

The ongoing pause on federal student loan payments, which has been in place since the start of the COVID-19 pandemic, has been extended through December 31, 2022. This will provide additional financial relief to borrowers as they navigate the economic challenges of the post-pandemic era.

3. Improvements to Income-Driven Repayment Plans

The plan also includes enhancements to income-driven repayment (IDR) plans, which allow borrowers to cap their monthly payments at a percentage of their discretionary income. These improvements aim to make IDR plans more accessible and beneficial for borrowers, potentially reducing their overall debt burden over time.

4. Targeted Debt Relief for Specific Groups

The plan also includes targeted debt relief for specific groups, such as Pell Grant recipients, who are typically from lower-income backgrounds and often face the greatest financial challenges in repaying their loans.

The Potential Impact of Biden’s Student Loan Relief Plan

The implementation of Biden’s student loan relief plan has the potential to deliver substantial benefits to both individual borrowers and the broader economy. Let’s explore some of the key potential impacts:

Financial Stability and Increased Spending Power

By reducing the burden of student loan payments, the plan could free up significant financial resources for borrowers, allowing them to allocate those funds towards other essential expenses, such as housing, healthcare, and consumer spending. This could have a ripple effect on the economy, potentially driving economic growth and job creation.

Improved Access to Higher Education

The prospect of student loan forgiveness may also encourage more individuals to pursue higher education, as the financial barriers to entry are reduced. This could lead to increased educational attainment and a more skilled and competitive workforce, further strengthening the economy in the long run.

Reduced Racial and Socioeconomic Disparities

Student loan debt disproportionately affects borrowers from marginalized communities, particularly Black and Hispanic individuals. By targeting debt relief towards Pell Grant recipients and lower-income borrowers, the plan has the potential to help narrow the wealth gap and promote greater social and economic equity.

Potential Drawbacks and Criticisms

While the potential benefits of Biden’s student loan relief plan are significant, the plan has also faced criticism and concerns from various stakeholders:

Concerns about Fiscal Responsibility

Some critics argue that the plan’s price tag, estimated to be around $300 billion, will place an undue burden on taxpayers and contribute to the growing federal deficit. They contend that the government should instead focus on addressing the root causes of the student debt crisis, such as the rising cost of higher education.

Potential Inflationary Pressures

There are also concerns that the injection of additional disposable income into the economy through debt relief could exacerbate inflationary pressures, which are already a significant concern for the Biden administration and the Federal Reserve.

Fairness and Equity Concerns

Another point of contention is the perceived unfairness of the plan, as it provides relief to some borrowers while excluding others, such as those who have already repaid their loans or opted for alternative educational paths. Some argue that the plan’s focus on debt cancellation fails to address the broader systemic issues surrounding higher education affordability.

The Legal Challenges and the Road Ahead

The implementation of Biden’s student loan relief plan has not been without legal challenges. Several Republican-led states and conservative groups have filed lawsuits, arguing that the president overstepped his authority and that the plan is unconstitutional.

The legal battles surrounding the plan are still ongoing, and the ultimate outcome will have significant implications for its long-term viability and impact. As the legal proceedings unfold, the Biden administration has expressed confidence in the legality of the plan and its commitment to ensure that it is implemented effectively.

Conclusion: The Significance of Biden’s Student Loan Relief Plan

Regardless of the ongoing legal and political debates, Biden’s student loan relief plan represents a significant and unprecedented step in addressing the student debt crisis in the United States. While the plan may not provide a complete solution to the deeper systemic issues underlying the problem, it offers a glimmer of hope for millions of Americans struggling under the weight of their educational debts.

As the plan continues to unfold and its long-term consequences become more apparent, it will undoubtedly shape the broader conversation around the role of government in addressing the challenges facing the higher education system and the financial well-being of its graduates. Ultimately, the success or failure of this plan will have far-reaching implications for the future of education, economic opportunity, and social equity in the United States.

FAQs

- Who is eligible for Biden’s student loan relief plan? Eligible borrowers are those with federal student loans who earned less than $125,000 (or couples filing taxes jointly who earned less than $250,000) in 2020 or 2021. Pell Grant recipients may be eligible for up to $20,000 in debt relief.

- How can borrowers apply for the student loan relief? The U.S. Department of Education has not yet released the application process, but they have indicated that it will be a simple, one-time application that borrowers can complete online. Borrowers should monitor the Department of Education’s website for updates on the application process.

- Will the student loan relief plan impact my credit score? The student loan relief plan should not directly impact borrowers’ credit scores. However, the reduction in outstanding debt could potentially improve their credit utilization ratio and overall credit profile, potentially leading to a positive impact on their credit score over time.

- How will the student loan relief plan be funded? The estimated $300 billion cost of the student loan relief plan will be funded through the federal budget, with no new taxes being implemented specifically for this purpose. The plan is expected to be paid for through a combination of existing federal funds and the projected reduction in the federal deficit.

- What about private student loans? Are they eligible for relief? Unfortunately, the Biden administration’s student loan relief plan only applies to federal student loans. Borrowers with private student loans are not eligible for debt cancellation under this particular plan. Private loan borrowers may need to explore other options, such as refinancing or income-driven repayment plans, to manage their debt.