How to Get Out of Credit Card Debt Fast

Getting out from under overwhelming credit card debt may seem daunting or even impossible at times. However, with some diligence, discipline, and planning, you can pay off credit card balances faster than you may think – no matter how deep in debt you currently find yourself.

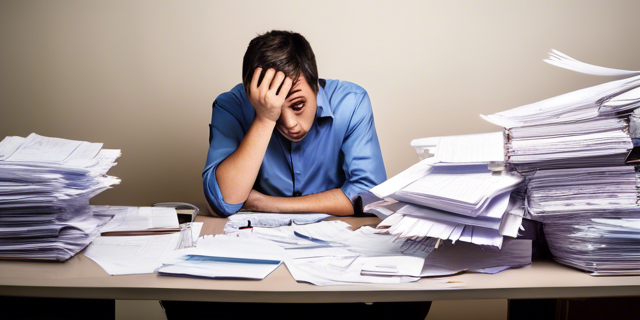

Take an Honest Look at Your Current Financial Situation

Staring down tens of thousands in credit card debt is an understandably depressing prospect. Before determining the best path forward, take time to fully understand your complete financial picture – good and bad. Gather recent bank statements, bills, a list of debts and your latest credit report so you know exactly what you owe and to whom.

While painful, facing reality helps in plotting your debt freedom journey. As entrepreneur Dave Ramsey wisely notes, “Denial is not just a river in Egypt” when it comes to overwhelming debt. Avoid sticking your head in the sand and hoping unpaid balances will somehow disappear.

Proven Ways On How to Get Out of Credit Card Debt Fast 2024: Why Debt Freedom Matters

Paying off high credit card balances delivers life-changing freedom from soul-crushing debt. Imagine no longer fielding frustrating calls from collectors or having your paycheck drained by steep interest payments month after month. Doesn’t that sound nice?

With this taste of freedom as inspiration, let’s explore proven strategies to get out of credit card debt forever.

Stop the Financial Bleeding with a Spending Freeze

Credit Card Debt Fast

When facing a dire medical diagnosis, doctors often first focus on “stopping the bleeding” before beginning rehabilitation. Think of overwhelming debt as a dire financial disease where spending less is the tourniquet that stops unwise bleeding of your limited funds.

**Institute an immediate spending freeze **on:

- Dining out

- Entertainment

- Unnecessary “wants”

This extreme frugality plan buys time to build savings and pay off debts without adding new balances. Make it a game to see how cheaply you can live while avoiding debt collectors in the interim.

Proven Ways On How to Get Out of Credit Card Debt Fast 2024: Build an Airtight Budget

An airtight budget aligns income and expenses so more money flows toward credit card balances each month. Budgeting works best when the entire household gets involved. Schedule a family money summit and make budgeting a team effort!

Tools like Quicken, Mint, Personal Capital and YNAB help create and manage home budget plans. But Excel or even paper/pencil works too. The key is listing all income and expenses, then slashing discretionary categories so more funds pay off debt.

Let the mindset of living below your means begin!

Pay Minimums on All Debts, Except One

Credit Card Debt Fast

When juggling multiple credit cards, a popular approach called “debt snowballing” recommends paying minimums on all debts while focusing any extra funds on eliminating one balance first.

List your credit card balances from lowest to highest amount owed instead of interest rate. Send everything possible each month toward wiping out the smallest debt first. Knocking off this initial balance builds momentum to tackle the next card using the freed up minimum payment plus added funds once the first card is paid off.

Appreciate Small Wins

Don’t underestimate the psychological boost from small wins. Paying off your store card that had a $200 balance eliminates a monthly bill and provides tangible progress. Celebrate this initial victory while staying focused on addressing the next smallest balance.

Debt freedom, here you come!

Explore Balance Transfer Options

Credit Card Debt Fast

Another strategy is using 0% balance transfer credit cards for breathing room. These cards offer 12+ months to pay off transferred balances without incurring interest. This gives time to pay down principal substantially before normal APRs kick in.

When exploring balance transfer cards, consider:

- Carefully read fine print about fees

- Check credit report first

- Focus on paying down principal during promos

Transferring balances to a lower interest card saves money once you stop overspending and alter habits that created debt initially.

Trim Expenses Without Living Like a Pauper

Learning how to reduce expenses significantly aids rapid debt reduction. While sticking to a strict budget, look for creative ways to cut costs in areas like:

Housing

- Downsize or take in renter

- Lower utilities

- Cut cable TV service

Food

- Meal plan/prep

- Cut grocery budget

- Brown bag lunches

Lifestyle

- Limit vacations/nights out

- Find free entertainment

- Reduce holiday spending

The goal is decreasing discretionary expenses substantially while avoiding feeling deprived. With diligence, you will find 20-40% or more in reducible costs that can accelerate debt payoff timelines.

Increase Income with a Side Hustle

Credit Card Debt Fast

Trademark guru Dave Ramsey preaches, “If you’re broke or poor, shift your focus. If you’re not making enough money, that’s the immediate problem to attack. Cut expenses and/or increase income.”

Improving cash flow paves a faster path to debt freedom. Consider:

Side Jobs

- Ride sharing

- Delivery driver

- Bartending

- Freelancing

Driving for Uber or Lyft nights/weekends provides a lucrative revenue stream without committing to a regular job. Or put existing skills to work freelancing or generating a side income stream until debts are defeated.

Then kiss those credit card balances goodbye for good!

Employ Cash-Only Spending

Another clever budgeting tactic is relying exclusively on old-fashioned cash for purchases instead of credit or debit cards. With this approach, called “cash-only” or “envelope budgeting,” you allocate X amount towards dining, groceries, clothes, etc. for the month by stuffing bills into envelopes representing each category.

When the envelopes are empty until next month, no more discretionary spending occurs. This avoids overspending perpetuated by swiping plastic. Cash also helps curb impulse purchases since you hand over physical bills with every transaction.

Utilizing a cash envelope system reinforces staying within financial limits – a key habit to rapidly reducing debt.

Increase Retirement Contributions

I know – sacrificing more paycheck income may seem counterintuitive when working feverishly to pay off credit cards. However, bumping up 401(k) or IRA retirement contributions minimally impacts monthly cash flow thanks to pre-tax payroll deductions.

Plus, certain accounts provide matching employer contributions, meaning free money towards retirement. Explore boosting contributions by even 1-2% to continue retirement funding momentum while attacking debt.

Remember, bankruptcy allows eliminating credit card debt but wiping away retirement assets. So protect this vital nest egg amidst eliminating unsecured consumer debts.

A balanced approach keeps all financial bases covered.

Get Professional Help Establishing a Debt Management Plan

For those facing truly overwhelming credit card or other unsecured debt burdens, consider contacting a non-profit credit counseling agency to assist managing the payoff process instead of pursuing bankruptcy.

Counselors help create a structured Debt Management Plan (DMP) spelling out repayment terms across outstanding debts based on income and expenses. This may feature reduced interest rates, waived fees, and assistance dealing with collectors.

How to Qualify for a DMP

Organizations like the National Foundation for Credit Counseling provide DMP services helping to*:

- Lower interest rates

- Consolidate payments

- Offer alternatives avoiding bankruptcy

- Provide free initial consultation

DMP eligibility often requires:

- Steady income

- Sufficient cash flow for repayment

- Willingness to close credit accounts

- Commitment disallowing new debt

Unsecured debts like medical/credit card bills are common candidates for DMPs. Read about the difference between secured and unsecured loans here. Typically mortgage, car, and federal student loan payments are made directly instead of routing through the repayment plan.

What Happens When You Default on a DMP?

Missing DMP payments often triggers removal from the structured plans and account closure. The counseling agency provides written notification of failure to meet the agreed upon terms.

Lenders receive notification of the broken arrangement as well and typically revert accounts back to original loan/interest terms. They also may resume their own internal debt collection efforts.

Bottom line – adhere closely to DMP guidelines and open communication channels if struggling to make monthly payments to retain helpful plan benefits and favorable terms.

The Long, Worthwhile Road to Complete Debt Freedom

Committing to a financial turnaround by rapidly eliminating credit card and other unsecured debt represents an extremely worthwhile endeavor – both financially and emotionally! Maintaining laser-like focus on this goal keeps motivation raging and leads to an amazing burden lifted that you’ll never forget.

While it may take months or even years to fully pay off balances depending on the size of debts, staying positive amidst the long journey and focusing on each little win accelerates reaching the debt freedom finish line.

Learning to live happily beneath your means makes room for other life dreams as well once excessive consumer debt no longer robs paychecks and steals joy! Hooray for fiscal fitness – your improved financial future awaits!

Conclusion

Climbing out from credit card debt may require difficult lifestyle adjustments to spending habits and diligent adherence to repayment plans. However, untold freedom and peace of mind await those escaping the bondage of oppressive debt by taking the necessary steps – no matter how hard they seem.

You must walk through the darkness to reach the light. By committing fully to the structured plans outlined above and securing supplemental assistance if needed, you CAN pay off any credit card balance faster than imagined.

It won’t be quick or easy. But plunging into a non-debtor lifestyle makes every sacrifice worthwhile. Imagine a life free of harassment calls from lenders, where your income feeds dreams instead of only making minimum payments.

That kind of financial freedom IS possible! So dig in heels and get ready to annihilate balances once and for all!

FAQs

What is the fastest way to pay off credit card debt?

The #1 fastest way is making much larger payments each month by increasing income with an additional job/side hustle and cutting expenses dramatically across the board. Every extra penny goes straight towards debt elimination.

How long does it take to pay off 20000 in credit card debt?

It depends on variables like interest rates, monthly payments, and loan terms. But paying $400 monthly towards a 20% APR $20000 balance would take roughly 6 years paying only minimums. Doubling payments shortens to 3 years. Revamping your financial plan accelerates the timeline.

Is debt consolidation a good idea?

Consolidation helps simplify payments by combining debts under a single lower rate loan. But it only aids paying down principal faster if you cut overspending habits. Consolidating without lifestyle changes leads deeper into debt. Get spending under control first.

Should I use savings to pay off credit card debt?

Generally yes – credit card interest rates exceed what savings accounts earn. Paying 19% APR debt with funds earning 1% annually equals smart money management. Just keep an emergency fund for surprises after eliminating high interest debts.

How does credit card interest work?

Issuers charge ongoing finance fees called interest that accumulate between billing cycles. It applies monthly to remaining balances after making a defined minimum payment. Only paying minimums causes interest build-up over years, increasing total repayment costs