Best States to Buy Rental Investment Property 2024

Best States to Buy Rental Investment Property 2024

Real estate investors have historically relied on rental income properties to generate passive revenue and build long-term wealth. As national home values continue rising faster than wages, affordable investment options still exist for those with sufficient capital and savvy. We identified the top state markets poised to deliver positive cash flows in 2024 based on key predictive indicators.

How is 2024 Shaping Up for Rental Property Investors?

The US housing market enters 2024 on uncertain footing as the Federal Reserve battles stubborn inflation through aggressive rate hikes. With mortgage rates double 2021 levels now exceeding 6%, home affordability has plummeted back to 1990 levels. This affects real estate investors in two opposing ways:

1. Purchase Challenge – Higher borrowing costs to obtain loans make it harder to find cash flowing properties that justify acquisition costs and expenses. Investors with all cash or large down payments hold advantage.

2. Renter Demand – As first time homebuyers get priced out of ownership, demand increases for affordable single family rentals and mid-market apartments. Properly screened tenants help offset note rates.

The key is targeting locations where rental demand outpaces supply boosts without insane property valuations. Markets like Boise and Phoenix that exploded in recent years now suffer slowing migration and corrections. Savvy investors should hunt secondary cities offering stability.

What Drives the Best Rental Property Markets?

Best States to Buy Rental Investment Property 2024

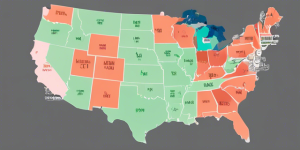

We assessed over 50 metrics across US cities and states to determine 2024’s optimal rental housing markets. Key selection criteria included:

- Low Unemployment – Employed tenants more likely to pay rents consistently

- ** Rising Wages** – Higher incomes support elevated rents to tenants and investors

- Affordable Pricing – Reasonable property values relative to rents in market

- Millennial Driven – America’s largest adult cohort needs apartments and first homes

- Business Friendliness – Employer and taxpayer friendly climates attract residents

- Future Growth – Economists predict above average expansion ahead

Markets excelling across these demand drivers should sustain smooth occupancy and cash flows for landlords. We also favored state income tax friendly locales for higher net yields.

Top 10 States to Buy Rental Properties 2024

Based on extensive market analytics, we predict these 10 states providing investors the best prospects to procure and profit from rental properties in 2024:

1. Tennessee

Major cities like Nashville and Memphis and smaller ones like Knoxville and Chattanooga feature prominent education and healthcare sector job creators. A popular southern destination for corporate expansions promises more growth ahead. Reasonable property valuations compared to rents persist, especially targeting Class B/C apartments and single family rentals.

Metro Nashville Area 2022 Rent Report

2. Florida

Always a migration magnet, Florida maintains immense appeal as baby boomers retire in droves to popular coastal metros. With no state tax income, Florida also attracts businesses. As single family and condo sales prices soar, rental demand for those unable to buy will heighten. Focus on neighborhoods near services and amenities.

Florida 2022 Rental Market Data

3. Texas

Ubiquitous job creation, especially in Houston and Dallas, accommodates Texas’ rapid population growth. Though home prices and property taxes have jumped in recent years, reasonable values can still be found in San Antonio, Fort Worth, suburban Houston and secondary markets. Avoid speculative plays.

Analysis of Texas Multi Family CRE Market

4. Georgia

Atlanta, Savannah and Augusta demonstrate solid fundamentals like employment and wage gains along with affordable pricing compared to other southeastern cities. Suburban Atlantan apartments, small multi-units and single family rentals should perform well attracting those priced out of owning.

Georgia Apartment Market Rent Forecast 2023

5. North Carolina

North Carolina’s research triangle region continues gaining high paying jobs as workers seek cheaper costs of living than adjacent Virginia and cities further northeast. Look for promising occupancy and rents around Charlotte, Raleigh, Durham and even tourism heavy Asheville as remote work trends persist.

Where are North Carolina Real Estate Markets Heading?

6. Ohio

Midwest affordability lures outsiders to Ohio metros like state capital Columbus, Cincinnati, Cleveland and Toledo. Healthy corporate environments, major universities and renown hospital systems should uphold employment and pay rates for in-demand renters as home prices outpace incomes in desirable neighborhoods.

Ohio Multi Family Commercial Real Estate Performance

7. South Carolina

Traditional value play Charleston continues gaining renown as a dining, arts and tech hub ideal for renters desiring southern charm. Upstate cities like Greenville, Spartanburg and Simpsonville display excellent quality of life to cost ratios. Avoid tourist dependent markets along the Grand Strand as seasonal volatility risk rises.

South Carolina 2023 Real Estate Market Predictions

8. Indiana

The Hoosier State lags its Midwest peer average for property value growth, positioning investors to secure relatively discounted assets in and around Indianapolis, Fort Wayne, Evansville, South Bend and Bloomington – home to Indiana University. Local landlords will benefit as talent stickiness rises.

Indiana Multi Family Market Shows Resiliency

9. Alabama

Fueled by growing aerospace and auto manufacturing presences spread across the state, Alabama delivers exceptional bang for the buck for real estate investors seeking double digit IRRs. Upward momentum should continue even if all markets moderate in 2024.

Birmingham Real Estate 2023 Forecast

10. Kentucky

Kentucky’s largest metro Louisville offers very reasonable single family rents relative to list prices despitesteady buyer demand. And the state’s business friendly policies attract ongoing corporate expansion and relocations providing tenant talent for landlords statewide.

Louisville Realtor Market Predictions 2023

Property Types Offering Top 2024 Returns

Best States to Buy Rental Investment Property 2024

We expect the following rental asset classes will deliver investors the highest risk-adjusted yields across our favored states this year based on various demand drivers:

Built For Rent Single Family

Private equity funds continue developing entire communities specifically for single family rental use given diminishing affordable for-sale housing inventory across suburban regions. Target metro fringes sporting household formation and income growth.

Class B Value Add Multifamily

Class A properties trading at premium valuations give Class B complexes opportunities to raise rents through interior and exterior facelifts post-acquisition. Priority metros hold high millennial concentrations needing affordable apartments.

Student Housing

While on campus dorms and luxury private accommodations overbuild in recent years, plenty of unrenovated properties near mid-sized universities offer turnaround potential as collegiate enrollments stabilize. Focus more on academics than athletics.

Secondary Market Upstarts

Look beyond the known major metro beneficiaries like Austin and Nashville seeking smaller yet similarly growing cities where asset inflation and regulations haven’t yet erased profit margins for operators and investors.

Blue Collar Single Family Rentals

Even modest 3 bedroom suburban homes with unfinished basements and privacy fenced back yards are becoming unaffordable for local first time buyers employed in lower paying service jobs. Their continued demand props up investment returns.

What to Avoid When Buying Investment Property

While dozens of markets major and minor exhibit positive demographic and asset trends for those acquiring rental housing in 2024, certain property situations remain more risky than advisable:

** Rural Markets**

Persistently negative net migration patterns into remote towns where economic opportunities are declining will fail to deliver tenant demand sufficient enough to offset operating costs and debt. Stick with growth instead of decline.

** Storm Impacted Coastlines**

Despite steep discounts on

properties damaged by recent hurricanes, avoiding additional catastrophe risk in coming years given climatologist predictions of intensifying storm systems makes better sense for conservative passive investors seeking sustainable yields.

** Overheated Appreciation Hubs **

Places like Boise and Phoenix that experienced exponential equity spikes in recent years based chiefly on inbound migration and institutional buying have corrected 20% or more and may further slide as demand retrenches faster than the supply catching up.

** Struggling Metro Office Markets**

Downtowns and urban cores dragged down by the combination of remote work adoption and recession risks should give investors pause as elevated vacancies in both commercial space and nearby apartments linger until reimagined revitalization initiatives gain traction.

** Unproven Alternative Assets**

While more adventurous investors might express interest in newly popular subsets like single family build-to-rent, fractional ownership, short-term furnished rentals or mobile home parks, most industry experts suggest waiting until successful precedents and business models become proven before pursuing.

How are Professional Investors Approaching 2024 Strategies?

In surveying top real estate investment trusts (REITs) and private equity firms who manage billions worth of US rental housing assets, we found most concentrating 2024 buying efforts on Sunbelt metros exhibiting jobs and migration momentum alongside still reasonable property valuations.

Especially alluring are secondary cities where housing affordability increasingly matters more as stock market volatility and recession worries make safety in cash flows paramount. Markets where high rents fully offset higher mortgage expenses should prevail regardless of purchase timing.

When seeking specific assets, those offering light interior cosmetic opportunities allowing operating expenses reductions and subsequent rent lifts are favored. Anything requiring heavy structural improvements or systems overhauls gets passed over for better baseline scenarios.

Investors also aim to retain existing property management infrastructure without interruption during acquisitions given talent shortages. No one wants vacancies occurring when demand still exceeds supply almost everywhere strategic buyers target.

What Due Diligence Should Investors Undertake?

Before committing capital to purchase rental housing in new markets, we advise obtaining objective third party perspective assessing critical assumptions made. Paying for unbiased data analysis and on the ground intelligence can either validate outlooks or reveal oversights.

Seeking local perspectives involves directly interfacing with key market constituents beyond transactions:

Brokers – Listing agents who deal in specific neighborhoods daily know the real demand dynamics, sale vs. list ratios and buyer overlap assuming tenancy or seeking it.

Property Managers – Those handling portfolios comparable to what an investor seeks possess tenant waitlists, turnover statistics and maintenance costs influences by climate and prevailing housing stock.

Employers – Economic development officials, corporate real estate VPs and site selection specialists provide market insight based on growth pursuits, industry initiatives and site planning.

Municipals – City planners, permit office managers, council members and county tax assessors explain present and future influences on housing costs, development plans, fees, taxes and regulations.

Contractors – Licensed general contractors familiar with target buy areas can detail construction material shortages, labor challenges, project timelines and overall cost trends for modeling assumptions.

Conclusion Key Takeaways

Markets offering rental property investors the best risk-adjusted returns share positive population and job growth fueling housing demand alongside relatively reasonable property valuations. These attributes allow landlords to push rents enough to offset rising financing and operating expenses.

Successful investors enter new markets only after thorough vetting of critical assumptions, tapping local sources beyond initial financial analyses. On the ground intelligence direct from brokers, property managers, employers, municipals and contractors provides objective validation or contraindication.

Getting 2024 rental investment decisions correct carries greater consequence given economic uncertainty on the horizon. Thoughtful planning and due diligence today lead to prosperity for years ahead.

Frequently Asked Questions

What is a good cap rate to target on rental property investments?

In today’s climate of rising borrowing costs and property values, investment target cap rates should be 5-6% minimum on value add to core plus apartment assets that allow for operational upside. Single family cap rates run slightly higher at 6 to 8%.

How many doors should real estate investors buy at once?

Portfolio size depends on one’s total investable capital and self-imposed portfolio concentration limits. Asses your risk tolerance. Buying individual long distance rental properties brings more onerous oversight than acquiring an entire multi-family complex ranging from 20 to 200 doors in the same metro area.

Are real estate investments safe if a recession hits?

Generally commercial and residential rental property withstands recessions better than other asset classes, although related construction and lending pauses. Difficulty refinancing debt presents some risk. Reasonably leveraged properties in growing metros with employed tenants should perform fine long run.

What prices and rents increases are expected in 2024? Home prices should rise around 5% given inflation and mortgage rates tempering demand. Multi-family rents could jump 7 to 9% while single family rents ascend 5 to 7% across our favored metro markets as incomes marginally rise but ownership affordability worsens driving rental demand.

When is the best time annually to close on investment property?

We prefer closing between November and February before peak leasing season begins allowing time to execute any prepping improvements or repairs necessary to secure optimal rents for coming 12 month cycle beginning in March through April across most US markets.