Best Budgeting Tips When You Have A Lot of Debt 2024

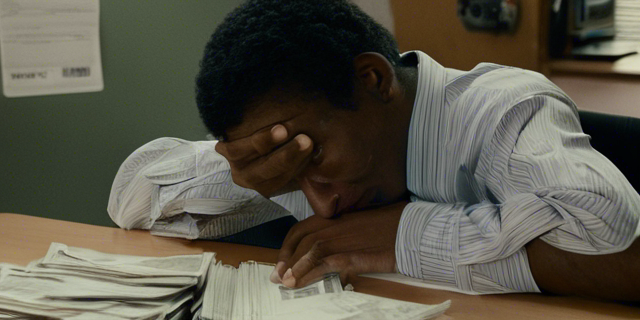

Being severely in debt can feel overwhelming. Budgeting money seems impossible when your income barely covers minimum payments. However, developing smart financial habits despite debt overload proves essential for wrestling back control of your finances.

Implementing a few critical strategies into a structured monthly budget empowers you to direct cash flow toward paying off balances. Consistently monitoring spending also enables adjustments when needed to align with repayment goals.

While chipping away at large debts requires patience and commitment, even modest progress feels empowering. Each little win staying on budget motivates bigger accomplishments until you eventually cross the finish line debt-free!

Start by Evaluating Total Debts

The high anxiety caused by out-of-control debt often prevents clearly seeing the full balance picture needed to formulate a focused repayment plan.

Create Your Debt List

Make a list of all debts showing remaining balances, minimum payments, interest rates, total monthly payments, and repayment term timeframes (if applicable). This overview of total money owed provides a baseline taking stock of the full situation.

Tracking everything in one place better equips you to make progress. Like any big project, dividing intimidating goals into smaller actionable chunks minimizes feeling overwhelmed.

Examples of debts to include:

- Credit cards

- Medical bills

- Personal, auto, or student loans

- Tax debts

- Payday loans

- Past-due utility bills

- Overdrawn bank fees

- Back-owed rent or child support

Confronting Debt Realistically Sets You Up for Success

Facing large debts causes discomfort. However, until you objectively assess the hard truths of current balances and required payments, you cannot craft an appropriate action plan aligning income and expenses to reflect reality. Think of this exercise as gathering battlefield intelligence critical for commanding victory.

Of course, ignoring frightening financial figures might temporarily lessen stress. But obscuring the facts also removes the clarity essential to changing them. Sometimes you have to endure the sudden pain of ripping off a bandage before treating and healing the underlying wound.

Analyze Income After Debt Assessment

Once you thoroughly understand outgoing monthly obligations, identify reliable income levels upon which to base spending decisions going forward.

Determine Net Monthly Household Income

Tally predictable monthly earnings after tax and other deductions across all family wage-earners. Unfortunately, counting on overtime or bonuses remains unwise for budgeting purposes. Base expectations only on normal base wages satisfactorily covering typical hours.

You must accurately determine net income remaining after debt payments before attempting to budget other expenses. This exercise establishes limits on remaining spending aligned with financial realities, not hopes or desires.

Examples to determine net income:

Gross wages – Taxes = Net wages Net wages – Debt payments = Remaining spending ability

Account for Income Fluctuations

Few workers receive perfectly predictable paychecks, especially freelancers or seasonal employees subject to volatile workflow changes. Make adjustments in savings goals during better earning months allowing a buffer for lighter periods.

Occasional windfalls like tax refunds or work bonuses also provide chances to make one-time overpayments on debts rather than inflating spending. Any extra cash offers opportunity to chip away at money owed.

Build Your Zero-Sum Budget

Now comes the strategic centerpiece helping manage cash flow – establishing a zero-sum monthly budget aligning all income and expenses based on real figures.

This comprehensive spending blueprint consciously directs every dollar earned toward intentional saving and debt repayment goals before discretionary items. Think of yourself as a ship commander committing available resources to achieve victory. Disciplined allocation ensures you stay the course.

Budgeting Methods

You can create your zero-sum budget using simple spreadsheets or programs like Quicken. List income sectioned into payment categories up to, but not exceeding total earnings. Here is a budget template outline:

- Net Income

- Debt payments

- Credit cards

- Loans

- Medical

- Taxes

- Housing

- Rent/mortgage

- Utilities

- Transportation

- Auto payment

- Insurance

- Gas

- Food

- Medical

- Family obligations

- Remaining for discretionary spending

- Debt payments

Use Smaller Envelop Budgeting With Cash

While monitoring overall balances proves vital, additional budgeting tactics like stuffing cash envelopes assigned for weekly incidental categories provides better visibility curbing overspending. Converting abstract electronic payments into tangible dollar bills heightens practical limitations. Envelopes empty faster than debits deducted virtually.

Employ This Envelope Budget Strategy

- Label envelopes by expense (gas, food, etc.)

- Stuff designated amounts in each when funded

- Only spend using cash from assigned envelopes

- Stop spending when empty till next funding

Physically handing over your last dollars brings much more emotional discomfort compared to swiping plastic. Repeatedly empty envelopes demand evaluating necessary cutbacks reshaping established spending habits.

Cutting Costs Releases More Money For Debts

After calculating income and baseline expenses through budgeting, significant debt repayment requires lowering discretionary spending below typical comfort levels. Sacrificing extras makes it possible to redirect more money toward balances owed.

Identify Top Budget Items Open For Reduction

With nondiscretionary fixed costs already minimized, examine flexible discretionary areas allowing cutbacks without major lifestyle impacts.

Big targets for downsizing include:

- Dining and entertainment

- Subscription services

- Memberships and hobbies

- Travel and vacations

- New clothing purchases

Temporarily deleting expenses not currently essential during focused repayment efforts greatly amplifies progress. Fun should still happen on occasion, just scaled back substantially. Slowly restart suspended items after reaching financial milestones.

Set specific reduction goals for top budget categories requiring cutbacks. Clearly defined targets enable consciously noticing overspending quirks commonly occurring far below awareness otherwise.

Schedule & Automate Finances

Managing variable income and obligations momentum emerges from systematizing key actions on a defined timeline. Assigned dates provide order and accountability minimizing reactionary decisions or procrastination while ensuring regular progress.

Calendar Critical Financial Tasks

- Payroll dates

- Bill due dates

- Debt payments

- Budget reviews

- Savings contributions

Repetitive automatic transfers into designated accounts allows seamless hands-off savings growing behind the scenes until enough accumulates for focused applications like:

- Extra debt payments

- Emergency fund

- Holiday spending pool

Automate for Set-It & Forget-It Consistency

Online banking automation ensures you execute defined actions without requiring motivation or reminders. Required monthly minimums reliably process on schedule plus additions when excess funds allow.

Determine to automate aspects requiring the most discipline like:

- Bill payments

- Debt payments

- Savings transfers

- IRA contributions

Consistently Monitor & Measure Financial Progress

You cannot improve what you do not measure. Tracking key monthly budget benchmarks provides visibility detecting when expenses exceed targets or when cutbacks allow for extra debt payments from freed up income.

Update & Compare Monthly Performance

- Document total debts paid

- Compare budgets vs. actual spending

- Note goals achieved (reduced utility costs, lowered grocery bills)

- Calculate interest savings from overpayments

- Check credit reports for score improvements

Create simple charts plotting debt repayment and savings growth over time. Visual improvements sustain motivation continuing progress.

Conduct Regular Budget Reviews

As economic conditions and personal situations evolve, periodically review the budget keeping your financial blueprint aligned with life changes to prevent backsliding.

Quarterly Assessments

Each season, examine income fluctuations and pay increases against inflation impacts upon gas, food, or other common expenses. Revise targets higher or lower accordingly.

Confirm bank automation settings still direct optimal amounts capturing available funds for key priorities like debts owed, emergency reserves, or retirement contributions without unnecessary residual waste.

Course Correct Spending Creep

Especially coming out of stressful heavy-debt seasons, enjoying extra flexibility as balances fall sometimes encourages unjustified lifestyle inflation rather than continual resource allocation focused on intentional targets.

Carefully contain lifestyle upgrades only to reasonable levels supported by your new financial footing, not representing a complete backwards policy abandonment. Your essential principles and sound money habits rarely require dramatic overhaul.

Shift Gears Accordingly At Debt Milestones

As major debts get fully defeated, funnel freed up monthly obligations toward the next priority target. Stacked successes building momentum results from constantly fighting against your next most dangerous dollar owed.

Defeating Debts One By One

The debt snowball method pays minimums across all balances while directing any extra money at defeating one small debt first before continuing up the chain to the next smallest.

Psychological victories eliminating each liability maintain enthusiasm despite requiring considerable patience knocking down large sums owed across months or years.

Visualizing debts as sinister enemies attacking from every angle provides fighting motivation to continually counterstrike against one target at a time until you gain the upper hand across every frontline financial challenge.

Some people first funnel bonuses or tax refunds toward toppling their smallest debt for quick wins even if higher interest balances remain. Other people strictly optimize by the numbers, always attacking the most expensive debt aimlessly of size. Do what keeps you motivated!

Build Emergency Savings

Once you Creator significant debt progress, redirect monthly surplus from eliminated payments toward establishing emergency cash reserves. Protect further financial threats going forward by saving at least 3-6 months’ expenses providing self-insurance for life’s curveballs.

Split Savings Goals

As debts decline through payments meeting minimums owed, dedicate half the newfound breathing room in your budget to special savings goals before relaxing restrictions on discretionary enjoyment. This balanced tactic focuses windfall energy on building both savings and fun money buckets.

Remaining 100% heads-down serious with money rarely proves sustainable long term. Allowing some budgetary rewards along the way prevents the deprivation from burning you out. Just don’t cancel all constructed boundaries in an overzealous celebration once monthly obligations lift!

Carefully redirect surplus funds into channels aligned with your values and life vision – whether passion projects, secured savings, college funds, or adventure travels. Discover what matters most and funnel resources accordingly.

Conclusion:

Climbing out from large debts on a limited income requires carefully constructing a zero-sum budget aligning earnings with intentional spending targeted at repayment. Monitor discretionary costs for reduction opportunities and utilize automation tools and calendars to enforce consistent financial actions allowing progress.

While the process challenges your resolve as months or years pass chipping away at balances, each little achievement provides motivation to forge ahead. Visualizing debt freedom by a specific future milestone date assists persisting through present hardships by making the outcome feel tangible.

Implementing committed budgetary discipline today enables reaching that goal tomorrow. Progress will happen slow or fast, but will reliably build through continuous applied effort. Your focused tenacity ensures you cross the debt freedom finish line eventually – where your newfound financial possibilities await without burden or limitation.

FAQs: Best Budgeting Tips When You Have A Lot of Debt 2024

How often should I review and adjust my budget when paying off debt?

Revisiting your zero-sum budget at least quarterly allows adjustments reacting to any income or expense deviations compared to original projections, ensuring continued accuracy and relevance guiding decisions.

What percentage of my income should I devote to debt repayment vs expenses?

Ideally allocate 50% or more of net income toward total debt obligations including minimum payments across all balances plus any extra overpayments possible. Limit flexible spending to less than 50% on truly vital or unavoidable costs.

Is budgeting really necessary if I automate finances?

Yes, you still need an intentional written budget outlining your ideal income and spending breakdown. Automation simply enforces the transfers and bill payments you outlined in your budget without requiring manual action each month. But automation tools can’t tell you how much to designate toward each purpose. Budgeting provides the strategic roadmap guiding your automation settings.

Should I cut costs, increase income, or both when repaying debt?

Finding opportunities to earn supplemental income accelerates results. But reducing unnecessary costs in tandem ensures you redirect the highest percentage of limited resources toward repayment goals without leakage. The combined effect magnifies your financial traction tremendously.

What are the first three things I should automate when paying off debt?

- Minimum debt payments so nothing gets paid late. 2) Bill payments to retain good standing on obligations despite fluctuations. 3) Additional debt payments making progress regardless of motivation levels any given month. This ensures consistency in the right habits.

Fine way of telling, and good article to get facts

about my presentation focus, which i am going to deliver in academy.