How Does Debt Consolidation Affect Your Credit Score?

Debt Consolidation, Credit Score

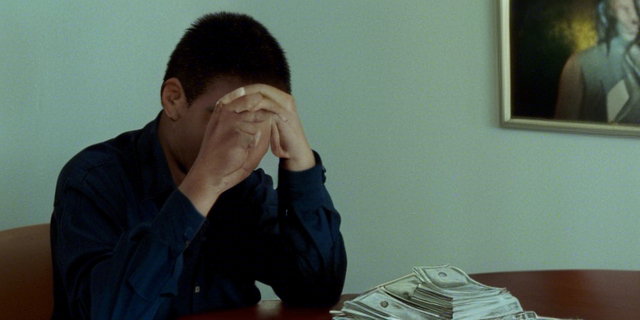

Feeling overwhelmed by high-interest credit card balances, medical bills, or other debts? Debt consolidation offers a solution – but at what cost to your credit?

This common relief strategy combines multiple debts into one new consolidated loan with lower monthly payments. Sounds great, right?

However, debt consolidation impacts your credit score in some nuanced ways. Improving scores requires knowing exactly how the changeover affects credit reporting and scoring calculations.

Let’s explore common consolidation techniques, their short and long term influences on credit, plus tips to mitigate risks.

What Is Debt Consolidation?

Debt Consolidation, Credit Score

Debt consolidation simply means replacing multiple individual debts with a new single consolidated loan having one payment at a lower interest rate. This makes repayment more manageable.

Consolidation usually combines credit card balances since cards charge higher interest compared to other lending. However, other eligible debts like medical bills, payday loans, auto loans, or student loans can consolidate too.

There are two main consolidation methods:

Balance transfer cards – Transfer all balances to a new credit card charging 0% introductory interest for 12-21 months

Consolidation loans – Combine all debts into one personal installment loan

Now let’s examine how these strategies influence credit scores based on reporting changes.

How Consolidation Impacts Credit Utilization

The biggest factor driving most credit scores is credit utilization – specifically, the percentage of total available revolving credit actually in use.

For example, having credit card balances totaling $5,000 across cards with a combined $10,000 limit gives 50% utilization.

Scoring models consider utilization exceeding 30% as negative and risky. Keeping it below 10% helps scores the most.

This means debt consolidation improves credit temporarily by lowering your overall utilization.

The Quick Fix of Lower Utilization

Combining $5,000 of card debt onto a new card with a fresh $10,000 limit changes utilization favorably from 50% down to 30% instantly. Nice!

However, score gains from this quick utilization win tend fade once the consolidated balance starts climbing again with ongoing charges.

Still, in the short run, reduced utilization from consolidation boosts scores – which is helpful when applying for mortgages, auto loans, or other major financing.

So consolidation clears some score headroom through utilization, but truly raising credit takes more effort. What else affects the numbers?

The Credit Mix Factor in Scoring

Beyond just utilization, most scoring models also consider your credit mix – the balanced diversity of loan types reported – as a positive.

For example, having both revolving credit card balances plus fixed installment loans like an auto loan improves mix. This signals you capably manage diverse credit types.

However, consolidating debts using a balance transfer card actually worsens your mix temporarily since all debts shift to a revolving account.

On the other hand, taking a consolidation installment loan to pay cards does enhance mix since the new loan is fixed.

So keep the mix impact in mind when choosing a consolidation method.

How Consolidation Closes Old Accounts

Here’s an important revelation about how debt consolidation affects credit scoring – it closes old credit card accounts as balances pay off!

This matters because scoring models consider your longest aged accounts when calculating average account history. Older is better for raising scores.

For instance, say you have 5 credit cards averaging 5 years old, creating a 5 year credit history.

If consolidating debts closes your 10 year old card, history suddenly drops to just 3 years – sinking scores.

The key takeaway? Before consolidating, check if any old accounts close and consider implications to average history age. Leave oldest cards open even if paying to $0!

The VantageScore Scoring Model Differs

Most lenders actually use a score called VantageScore rather than the better-known FICO model. And VantageScore treats closed accounts differently.

Unlike FICO, VantageScore continues factoring paid cards into history averages for 24 months after closure. This reduces hits from consolidating old cards.

However, keeping longevity intact still helps both models long term. Let’s look closer at account history impacts over time.

Monitoring History Changes Long Term

Early on, consolidation improves utilization and credit mix categories for quick score gains. Nice start!

However, as closed accounts fall off reports over the months after consolidation, history lengths start declining. And lower average age gradually suppresses scores.

Say Sam has 4 credit cards averaging 4 years old. He consolidates card debt using a balance transfer card, paying off and closing the other three 4 year old cards.

Initially after consolidating, Sam’s utilization and mix improve, raising his scores. But as his now-closed 4 year cards drop off reports over the next few years, his average history lowers from 4 years towards only reflecting the newer consolidated card.

This slow downward effect means debt consolidation ultimately worsens credit in the long run as closed lengths fall off.

The key takeaways?

Keep old accounts open even if paid off to preserve positive history. And use any early score gains from consolidation strategically for key financing needs.

Best Practices to Minimize Credit Impacts

While consolidation can provide short-term scoring benefits, ensure the long run effect minimizes too by:

Keeping old accounts open – Leave longtime cards open after consolidating even with $0 balances

Monitoring score versions – Check both FICO and VantageScores to detect changes

Using gains strategically – Use early utilization improvements to secure favorable financing rates on must-have loans

Resuming diverse usage long term – Once debts consolidate, begin occasional small spending on old open revolving accounts avoided closure

These steps help optimize scores across consolidation changes.

Considering How Consolidation Affects Debt-to-Income

Beyond credit reports, debt consolidation also changes another key factor lenders review before approving loans – debt-to-income ratio.

Also called DTI, this ratio compares minimum monthly debt payments to your gross monthly income. It measures spare income free for additional borrowing.

Lenders usually require DTI below 50% to qualify borrowers. Excellent ratios fall below 30%.

The math looks like:

Total Minimum Monthly Debt Payments / Gross Monthly Income = Debt-to-Income Ratio

Since consolidation loans reduce total payments through lowered interest rates or extended repayment terms, DTI mathematically declines too.

This DTI improvement positions borrowers to better qualify for mortgages, auto loans and other major needs less than six months after consolidating.

So keep the positive DTI impact in mind too!

Closing Thoughts on Consolidation and Credit

Debt consolidation offers a mix of credit score pros and cons to consider before committing.

The strategy temporarily improves utilization and mix factors while helping debt-to-income ratios. This opens short term financing opportunities if used strategically.

But long term, consolidation can reduce average account history lengths as closed accounts fall off credit reports – gradually lowering scores over time.

Knowing these dynamics allows expecting the score fluctuations and timing major borrowing needs accordingly. Just be sure to keep longtime cards open for history length even if paying to $0 balance through consolidation loans.

While no debt relief route avoids sacrifice, consolidation paired with diligent balance payoff provides workable improvement within the scoring dynamics every consumer faces.

Consolidation and Credit Score FAQs

How much does debt consolidation lower your credit score?

Expect an initial increase, perhaps 30+ points from lowered utilization when first consolidating. Then slow declines of 20-30 points over 1-2 years as closed accounts fall off credit history. These ranges assume on-time payments.

Does consolidating credit card debt hurt your credit?

Temporarily it should help by sharply dropping utilization percentages and mixing up credit types. But if longtime accounts close, average history lengths decline over the next couple years which lowers scores gradually.

Is it better to pay off credit cards or consolidate?

Paying off cards protects more aging history but requires much greater monthly outflow. Consolidating offers lower payments providing cards stay open even if paid off. Finances and willpower determine which path works best.

What happens if you consolidate debt and max out cards again?

Falling back into high card usage after consolidation essentially erases the utilization benefit. It’s critical to change spending habits and use cards minimally after consolidating so scores sustain improvement.

Should I consolidate debt before or after buying a house?

Do it before. The utilization and mix boosts from consolidating and associated debt-to-income improvements will help home loan approval more than waiting. Just be sure to keep old accounts open so history lengths remain intact.