How to Deal With Debt Collectors and Harassment

How to Deal With Debt Collectors and Harassment 2024

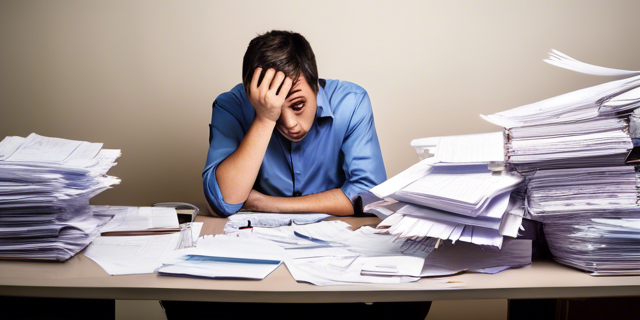

Dealing with debt collectors can be stressful, but knowing your rights is key. This guide will provide actionable tips for professionally engaging with collectors while stopping harassment in its tracks. We’ll cover critical laws like the Fair Debt Collection Practices Act (FDCPA) and best practices to protect yourself every step of the way.

Understand the Debt Collection Process

Before diving into dealing with collectors, it’s helpful to understand the debt collection process typically followed:

Original Creditors

The original creditor, like a credit card company or hospital, attempts to collect on a debt. If unable to, they may sell it to a debt buyer.

Debt Buyers

Debt buyers purchase unpaid debts in bulk for pennies on the dollar, hoping to eventually turn a profit. The buyer becomes the new creditor.

Collection Agencies

Creditors often enlist collection agencies to pursue debts on their behalf. The agencies receive a percentage of what they collect.

Legal Action

If agencies are unsuccessful, the creditor may enlist attorneys or file lawsuits to attempt to recover assets or wages.

Know Your Rights Under the FDCPA

How to Deal With Debt Collectors and Harassment 2024

The Fair Debt Collection Practices Act (FDCPA) provides federal guidelines governing collections. Key rights include:

Cease Communication

You can request for agencies to stop contacting you. They legally must honor this written request. Note they may still sue.

Dispute Debts

You can dispute debts and request debt validation. Collectors must then provide proof you owe the debt.

Restrict Contact Times/Methods/Frequency

Collectors have limited times they may contact you without permission. Normal business hours are acceptable.

Be Proactive with Original Creditors

Dealing with original creditors before debts go to collectors should be a top priority. Consider steps like:

Negotiating Payment Plans

See if they’ll accept smaller monthly payments you can truly afford. Get any promises of altered repayment plans in writing.

Request Rate Reductions

Interest rates directly impact how quickly balances grow.politely [but firmly] ask for lower rates citing hardship.

Utilize Debt Counseling Resources

Non-profit credit counseling services can often negotiate better terms directly with creditors. They also provide financial education and advice developing repayment plans based on your budget and goals.

How to Deal With Debt Collectors and Harassment 2024Prioritize Collector Contact

Once in collections, prompt engagement with agencies is critical:

Don’t Ignore Calls/Letters

While frustrating, avoiding collectors allows them to control the narrative. Silence can be interpreted the worst way.

Answer Calls Prepared

Before answering, know your rights, debts owed, budget and what you can pay. Draft a script to guide key points.

Record Interactions When Allowed

Transcripts or recordings create helpful records, especially if harassment occurs. Some states require both-party consent to record.

Take Notes

Log dates, names, contact details and summaries for every interaction. Notes help verify events.

Request Debt Validation

You can require collectors legally validate owed debts. Draft a debt validation letter formally requesting details confirming you actually owe the money claimed:

Amount Owed Breakdowns

Get clarification on the total balance owed, plus interest, fees and payment breakdowns.

Statements and Records

Ask for statements, receipts and records from the original creditor indicating charges and payments.

Complete Payment Histories

Payment histories detailing the life of the debt often highlight errors beneficial for dispute.

Dispute Inaccuracies

If provided documents reveal discrepancies about what you owe, formally dispute inaccuracies requesting removal from your reports.

Negotiate Debt Settlements

If properly validated, consider negotiating a settlement less than the full balance:

Lead with Financial Hardship

Explain unforeseen circumstances hurting your finances, framing why only smaller payments currently work.

Lowball Initial Offers

Offer 25-50% less than you’re willing to pay, leaving room to negotiate upward to your goal.

Don’t Share Full Financial Details

Avoid giving collectors full access to bank statements revealing assets they could pursue. Keep it high level focusing on hardships.

Get Final Terms in Writing

Once a verbal deal is reached, request they email/mail the offer’s final terms and conditions for proper documentation.

Carefully Weigh Debt Management Plans

Structured Debt Management Plans (DMPs) via credit counseling agencies can make handling payments easier, but consider drawbacks:

Monthly Administration Fees

While consolidating bills into one payment helps, the counseling agencies charge monthly fees reducing money paid to debts.

Accounts Remain Delinquent

Even with active DMPs creditors can still report your debt delinquent damaging credit further.

Potential Lawsuits Continue

Collectors on DMPs typically agree not to sue, but have no legal obligation stopping them if you default.

Protect Finances from Lawsuits

If served with a lawsuit summons, this signals the collector is pursuing a legal judgement:

Formally Dispute the Lawsuit

Draft an “Answer to Complaint” letter disputing specifics of the lawsuit while urgently seeking legal counsel.

Show Up!

Never miss court hearing dates related to debt judgements. Not showing accelerates a plaintiff’s win.

Explore Bankruptcy Potential

If debts are truly unmanageable and collectors aggressive, explore bankruptcy options for protection, restarting with a clean slate.

Master FDCPA Rights Against Harassment

Beyond misreported debts, abusive harassment by collectors also breaks FDCPA rules:

Block Numbers After Written Cease Communication

Request written confirmation of your cease communications demand. With proof in hand, save letters while blocking further calls/texts.

Report Offenders

Beyond blocking, report chronic harassment offenders to both Federal Trade Commission (FTC) and Consumer Finance Protection Bureau (CFPB) to face fines.

Sue for Actual and Statutory Damages

With strong evidence, victims can sue violators for compensation. Even small overlaps with FDCPA guidelines enable lawsuits carrying hefty statutory fines collectors must pay.

Conclusion

Dealing with debt collectors starts with promptly engaging to understand debts owed while beginning good faith negotiations. Collectors prioritizing abuse over meaningful solutions warrant blocking and reporting. Arm yourself with financial education and FDCPA expertise to regain control while protecting your long-term interests. The path ahead with hard work and patient, assertive self-advocacy leads to a brighter, stable tomorrow. You’ve got this!

FAQs: Debt Collectors and Harassment

What are debt collectors allowed to say to relatives?

Legally collectors may only discuss debts with the original debtor, their spouse or parents of debtors under 18. Revealing debts to any other relative or friend violates federal law.

Can debt collectors contact me after I file bankruptcy?

No. Upon filing bankruptcy, an “automatic stay” immediately activates legally blocking all debt and collection efforts until bankruptcy courts resolve matters.

Can debt collectors take my home?

For primary mortgages, yes eventually collectors can foreclose forcing home sales to recover loan balances. For 2nd mortgages/HELOCs, collectors must first win judgements in court allowing forced sales.

Can debt collectors call my work?

Yes, but only once with permission. Further calls require additional consent. Collectors may call without permission if unable to reach you otherwise. Employers prohibit calls if requested.

Who do I complain to for FDCPA violations?

To formally complain about FDCPA violations by collectors contact both the FTC and the CFPB. Details on exact contacts are published online by both government agencies regarding debt collection matters.