How to Pay Off Student Loans Faster on a Low Income

Student Loans

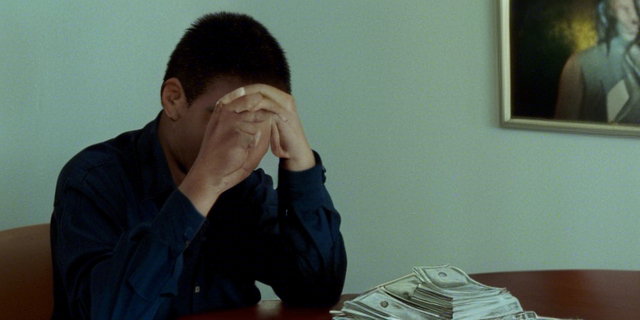

Heavy student debt feels like a mountain blocking dreams of buying homes, starting families, exploring careers or even just building basic savings. And that mountain towers higher when you’re stuck earning low wages. Thankfully several smart strategies exist helping borrowers chip away at that mountain faster than they expect. With some focused effort, even those earning modest incomes can summit student loan debt.

Start with Federal Student Loans

Generally it’s wisest to attack private student loans last since federal loans offer more flexibility. Focus first on Department of Education debt.

Enroll in Income-Driven Repayment (IDR)

IDR plans base monthly payments on earnings aiming for reasonable burdens as salaries rise and fall. Options include:

- Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

After 20-25 years of payments, balances are forgiven tax-free. Optimize IDR choices long term.

Submit Paperwork On Time

IDR plans require annual income documentation. Miss deadlines and payments spike to higher standard repayment rates. Set calendar reminders for paperwork and always submit weeks early.

Find Ways to Increase Income

Yes repaying student loans on low wages feels daunting. But avoiding the challenge won’t make debts disappear. Take action:

Develop New Skills

Use free resources to gain skills opening new income potential:

- Online certifications

- Library books

- YouTube tutorials

Search Better Opportunities

Dust off that resume and get actively networking. The next great job awaits!

Moonlight with Side Hustles

Uber driving, bartending, tutoring, etc provides extra cash attacking debt quickly.

Live Like a Student Now to Avoid Living Like One Forever

Student Loans

Yes, continuing extreme frugality post-college feels unfair giving peers financial freedom. But disciplined budgeting, even while steadily employed long term, maximizes repayment potential.

Cut expenses wherever possible:

- Eat beans and rice

- Milk that old car

- Freeze gym memberships

- Stay with parents to avoid rent

- Limit nights out drinking/dining

Saving money means saving future freedom!

Avoid Deferments

It’s tempting delaying loan payments using deferments or forbearances when finances strain. But except for extreme cases, this only delays the inevitable repayment another day while interest continues growing.

Stay strategic. Make minimum payments rather than defer. Optimize IDR plans keeping active payments that chip away at balances owed.

Pay Extra When Possible

Making required monthly payments keeps you compliant, but adding even small extra amounts accelerates progress significantly.

Think of it like finishing a marathon. Required training has you ready to finish 26.2 miles. But extra weekend jogs speed up race day!

Redirect Windfalls

Aim to make bi-weekly half payments rather than monthly payments. Tax refunds, birthday gifts or overtime wages all help knock down principal faster.

Consolidate Carefully

If you have federal loans with various servicers at varying rates, consolidation can benefit through simplifying life with just one payment.

But it’s critical loans are consolidated directly via the Department of Education for flexibility benefits. Private companies advertising consolidation often lead to loss of federal perks and false promises. Avoid them!

Explore Student Loan Forgiveness Options

Beyond IDR forgiveness after 20-25 years, other options like Public Service Loan Forgiveness (PSLF) erase debt for careers with public service agencies after just 10 years:

- Military

- Government

- 501c3 non-profits

- Healthcare

- Education

Vocations focused on public good rather than profits qualify. See complete PSLF eligibility guidelines.

Tackle Private Student Loans

Once federal student loan obligations shrink, next focus on typically much less flexible private student loans:

Communicate with Lenders

Explain your situation and explore options like lowered interest rates which help payments make bigger dents in principal owed.

Refinance if Possible

Good credit scores allow refinancing with companies like Earnest, SoFi, Splash Financial, etc for lower interest rates saving money long run.

Avoid Deferment Temptation

Just like federal loans, deferment seems appealing but only delays and increases costs.

Don’t Give Up – The End is Closer Than It Appears!

Despite best efforts, repayment hurdles pop up, for example:

- Health emergencies

- Family needs

- Periods of unemployment

When stumbling, regain perspective remembering the long term vision to be student debt free. Recommit rather than quit!

Conclusion

Paying off loans often feels hopeless on lower incomes. But implementing income-driven repayment, finding side hustles to grow earnings faster, maximizing budgets and exploring alternate forgiveness programs opens doors. Step by step loans can be defeated faster than imagined! Just like a marathon, take that next step. The finish line ahead comes quicker than you think!

FAQs

Should I enroll in an expensive “student loan forgiveness service”?

Generally avoid paying anyone for services claiming insider tricks accelerating loan forgiveness. Government resources guide you through all options free of cost if you put in effort.

Can my loans get discharged through bankruptcy?

Rarely, as student loans carry tougher discharge rules than other debts. Unless facing undue hardships, focus efforts on repayment diligence rather than bankruptcy.

Are incomes too high to receive payment reductions from IDR Plans?

Not really, as the REPAYE plan guarantees anyone no matter income a 10% payment reduction minimum compared to standard repayment plans. Those earning higher wages just end up paying loans off faster.

How do I get employers to help pay off student loans?

Advocate for yourself! More companies now offer student loan repayment assistance benefits attracting top talent who aggressively negotiate their offers during hiring discussions.

What government professions offer student loan forgiveness?

Beyond military service forgiving 33% after 3 years, public defenders attorneys can eliminate remaining debt after 10 years. Various state and federal agencies also offer incentives tied to years of service.