Beginner’s Checklist for Paying Off Debt Fast

Beginner’s Checklist for Paying Off Debt Fast 2024

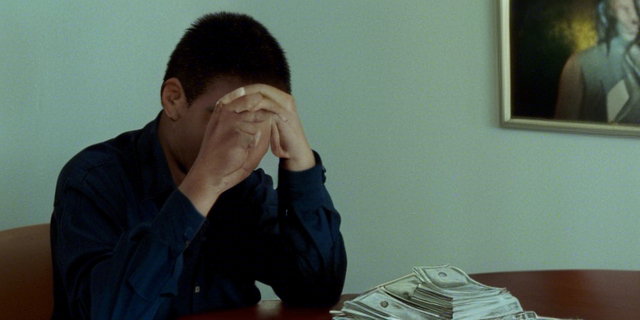

Paying down debt quickly often feels impossible, but many everyday people find their way out of heavy debt burdens every day. With some practical planning, prioritization and discipline, you can too! This beginner’s guide covers critical strategies speeding up your debt pay off journey.

Take Stock of Current Debts

Before strategizing, understand all debt obligations:

- List All Accounts – Track credit cards, medical bills, personal loans, auto loans, mortgages, student loans, back taxes owed, etc.

- Record Balances & Terms – Note current balances, interest rates, minimum payments, payment due dates, etc.

- Check Credit Reports – Ensure no debts are missing. Reports from AnnualCreditReport.com itemize obligations.

- Determine Total Owed – Add up all current balances. Facing this bottom line number often wakes people up to start addressing debt.

Getting Motivated

Paying off substantial debts tests one’s motivation. Consider focusing on reasons like:

- Achieving financial freedom from debt’s daily burden

- Reducing stress that comes with juggling payments

- Building savings by redirecting freed-up money

- Exploring new careers by reducing income dependence

Also reflect on how debts accumulated. Being accountable often reenergizes commitment toward solutions.

Adopt a Debt Payoff Strategy

Beginner’s Checklist for Paying Off Debt Fast 2024

Choose a strategy targeting either highest interest rates, lowest balances first, or a hybrid “debt snowball” approach:

Highest Interest First

Mathematically this saves the most money long term by eliminating higher interest costs sooner.

Lowest Balance First

Some prefer “quick wins” eliminating small debts first, lightening the load and building momentum psychologically.

Debt Snowball Method

Pay minimums on all debts, while aggressively focusing any extra funds against the smallest balance first before rolling onto the next smallest. This blends aspects of both high interest and low balance strategies popularized by finance personality Dave Ramsey.

Proven Beginner’s Checklist for Paying Off Debt Fast 2024: Reduce Interest Rates

Interest radically slows debt repayments. Call lenders negotiating better rates or consolidation options. Be persistent searching for savings. Some options:

- Hardship Programs – Documentation of financial struggles can lead to reduced credit card interest rates.

- Balance Transfers – Transferring credit card balances to new 0% interest cards enables 100% of payments to hit principal balances directly for a period of time depending on card offers.

- Consolidation Loans – Banks will fund loans allowing people to consolidate and payoff multiple debts under one payment at a lower interest rate.

Cut Expenses

Freeing up monthly cash flow is crucial when attacking debt. Building a lean budget cuts fat enabling faster payoffs:

Housing

- Downsize space

- Take roommates

- Renegotiate rent/mortgage

Transportation

- Sell extra vehicles

- Use public transportation

- Bike/walk more

Insurance

- Raise deductibles

- Drop optional policies

Utilities

- Picture perfect lawn/home matters less than paying off debt! Adjust accordingly.

Increase Income

Beyond cutting costs, extra income accelerates payoff potential:

Primary Job

- Ask for a raise

- Search for better paying roles

- Take overtime shifts/freelance gigs

Secondary Job

- Nights/weekends waiting tables

- Rideshare driving

- Child/pet sitting

Sell Unnecessary Assets

- Cars, electronics, instruments, valuables, etc.

Attack Debts Aggressively

With barebones budget set and extra income rolling in, get aggressive repaying debts!

List Debts Smallest to Largest

The debt snowball method starts with smallest balances first.

Pay Minimums on All Debts

Freed up monthly surplus gets firepower focused on the smallest balance first.

Pay Extra Toward Smallest Debt

Every extra dollar goes toward the smallest debt while making minimums elsewhere.

Repeat with Next Smallest

Keep eliminating debts one by one till you’re debt free!

Save Up In Case of Emergencies

Despite best efforts, unexpected crises sabotage debt plans:

- Medical bills from accidents/illnesses

- Surprise home or auto repairs

- Temporary job loss

Having some cash reserves enables managing surprises without sliding deeper into debt.

Avoid Combative Relations With Lenders

Lenders can make the journey easier through hardship help or make it harder sending accounts to collections.

Communicate Honestly

Contact lenders early explaining circumstances and willingness to repay. Transparency and politeness go a long way.

Seek Win/Win Solutions

Acknowledge lenders’ expectations while firmly but collaboratively seeking solutions working for both parties.

Celebrate Milestones

Measurable progress uplifts spirits keeping momentum strong. Consider monthly victories like:

- Paying off the first debt

- 10% reduction milestones

- Consistently sticking to budgets

- Sacrifices finally bearing fruit!

Adjust approaches

Imperfect execution is normal. Self reflect on what works versus unrealistic tactics requiring tweaks:

- Be flexible trying new debt payoff methods

- Seek help from debt counseling services

- Address root overspending habits

- Adjust budgets when goals fall short

Conclusion

Paying off debt often demands sacrifice, discipline and accountability long term. But sticking to the fundamentals – tracking totals owed, reducing interest rates, cutting expenses, earning more income and directing surpluses toward debts systematically – leads to financial freedom faster than you think! Celebrate small wins while collaboratively working with lenders. With clear eyes, creativity and commitment, you’ve got this!

FAQs: Beginner’s Checklist for Paying Off Debt Fast 2024

Should I use my 401K to pay off debt?

Generally it’s not recommended to use retirement savings for other priorities. Explore budget cuts or debt consolidations loans instead. But for extremes like bankruptcy risks, the IRS allows limited 401K withdrawals to pay debts.

What happens if I stop paying my debts?

Missed payments prompt collections calls, credit damage, potential asset seizure, garnished wages, and lawsuits. Actively communicating with lenders while making good faith partial payments shows responsibility.

Is debt settlement cheaper than bankruptcy?

Sometimes. Debt settlements negotiate reduced payoffs, but require lump sum payments. Bankruptcy eliminates most debt, but wrecks credit for years. Weigh options carefully based on circumstances.

Should I set aside savings if I’m in debt?

Generally it’s wise to stockpile a small emergency fund even when aggressively paying off debts. Life happens, so having some cash prevents further debt reliance if the unexpected strikes.

Are there tax implications on forgiven debt?

Yes, in some cases lenders issue 1099-C tax forms for canceled/forgiven debt. Federal taxes may be owed on the forgiven amount. Certain exceptions apply. Consult credit counselors/CPAs to understand possible tax issues.